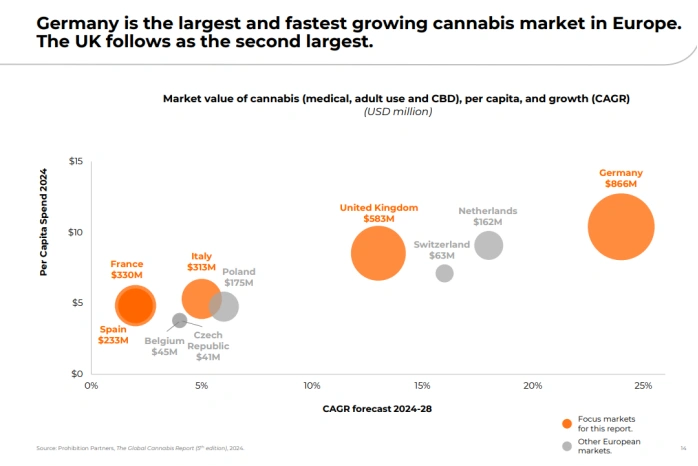

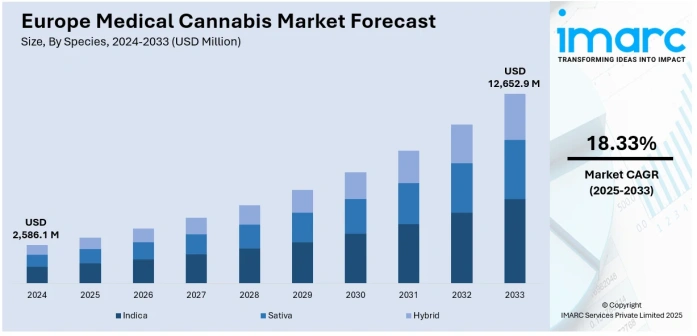

The European cannabis market represents a multi-billion dollar opportunity that is simultaneously tantalizing and bewildering for industry stakeholders. With the European medical cannabis industry valued at $2.59 billion in 2024 and projected to reach $12.65 billion by 2033, the prize is clear. However, navigating this fragmented regulatory landscape—where each nation maintains distinct policies, medical frameworks, and enforcement mechanisms—creates a fog of uncertainty that confounds even seasoned cannabis executives.

Cannafest Prague 2025, held November 7-9 at PVA Expo Prague Letňany, is not merely another trade show on the cannabis circuit. This fifteenth annual gathering of approximately 250 exhibitors from across the globe functions as a crucial barometer—a living data set that, when analyzed correctly, provides detailed forecasts of market trajectory, investment focus, and regulatory direction for the entire European continent. In this analysis, we will deconstruct Cannafest 2025 by examining four key pillars: the exhibitor landscape, the conference agenda, product innovation, and the geopolitical context. From this examination, we will distill actionable strategic takeaways for any business looking to navigate or enter the European market.

The Geopolitical Context: Why Prague is the Perfect Vantage Point

Germany’s Gravity

Germany’s April 2024 cannabis legalization under the Cannabis Act (CanG) acts as the central gravitational force for the entire European Union market. The legislation’s “Pillar 1” enabled decriminalization of personal possession up to 25 grams and home cultivation of up to three plants per household, while also establishing non-profit “cannabis social clubs”. Any trends visible at Cannafest will be heavily influenced by the needs of the German market, as it represents the largest economy in Europe pursuing cannabis reform.

The highly anticipated “Pillar 2”—federally approved commercial pilot projects in selected municipalities for adult-use retail sales—remains in political limbo as of October 2025. Multiple German cities including Berlin, Frankfurt, and Hanover submitted proposals for pilot programs, but federal-level uncertainty and the 2025 elections have left the commercial supply chain framework unresolved. This uncertainty creates both challenges and opportunities that are actively discussed at events like Cannafest.

The Czech Republic’s Progressive Stance

The Czech Republic itself has emerged as a progressive force in European cannabis policy, making Prague an ideal neutral ground for Cannafest. In July 2025, Czech President Petr Pavel signed historic cannabis legalization legislation that will take effect January 1, 2026. The new law permits adults over 21 to cultivate up to three plants in private residences, possess up to 100 grams privately and 25 grams publicly, while public consumption remains prohibited.

Notably, the Czech Republic has maintained a history of cannabis tolerance, having first decriminalized small amounts for personal use in 2010, though that policy was subsequently invalidated by a Constitutional Court ruling in 2013. This progressive stance, combined with the country’s central European location and established cannabis culture, positions Prague as the ideal meeting point for stakeholders navigating Europe’s complex regulatory environment.

The EU Patchwork Quilt

Beyond Germany and the Czech Republic, the European cannabis landscape resembles a patchwork quilt of disparate regulatory systems. Malta, Luxembourg, and Germany have implemented national adult-use legalization measures, while the Netherlands and Switzerland operate regional pilot trials despite recreational cannabis remaining prohibited at the national level. Portugal maintains its decriminalization approach, while countries like Italy have recently moved in the opposite direction with Decree-Law 48/2025 effectively banning CBD products.

This regulatory fragmentation establishes the complex backdrop against which Cannafest takes place—serving as the rare forum where stakeholders from permissive, restrictive, and everything-in-between jurisdictions can meet, compare notes, and identify emerging pan-European opportunities.

The Exhibitor Landscape as a Market Map

The Cannafest exhibitor list functions as a real-time map of where capital and resources are flowing within the European cannabis ecosystem. With approximately 250 exhibitors representing cutting-edge solutions across cultivation, processing, packaging, distribution, and retail, the floor plan itself tells a story about market maturity. The 2024 edition featured 221 exhibitors with representation from over 60 countries and 20+ industries, demonstrating the event’s international draw.

The Balance of Power: Cultivation Tech vs. CPG/Retail Solutions

A critical metric for assessing market maturity is the relative balance between cultivation technology providers versus consumer packaged goods (CPG) and retail solution vendors. Early-stage markets typically feature heavy representation from lighting companies, hydroponics suppliers, seed banks, and growing equipment manufacturers—all signals of an infrastructure build-out phase. As markets mature, the exhibition floor shifts toward point-of-sale systems, branding agencies, packaging companies, and marketing services.

At Cannafest 2025, exhibitors span categories including natural resources, CBD products, growing equipment, growshops, seeds, vaporization technology, and paraphernalia. This diverse representation suggests a market in transition—still building foundational infrastructure while simultaneously developing sophisticated consumer-facing capabilities. The presence of hemp cosmetics, textiles, and food products alongside cultivation technology indicates a maturing ecosystem that extends well beyond simple flower production.

The North American “Invasion”: Gauging International Interest

The presence or absence of major United States and Canadian Multi-State Operators (MSOs) at European exhibitions provides crucial signals about their expansion timelines and strategic priorities. Recent reporting confirms that Europe has become the top target for cannabis industry expansion, particularly for US-based companies seeking international growth. European markets are especially enticing for companies based in the United States looking to expand internationally, driven by Germany’s legalization and the continent’s relatively untapped potential.

North American investment in the European Union cannabis industry has already topped $600 million, with companies actively preparing for the next wave of capital influx. Major international operators like Curaleaf, Tilray, and Aurora have been leveraging their scale to break into UK and European markets, establishing beachheads ahead of broader commercialization. Their level of investment in major European shows like Cannafest signals confidence in near-term expansion timelines despite regulatory uncertainties.

The Rise of European Champions

Perhaps the most significant development visible at Cannafest is the prominence of homegrown European cannabis champions. German, Czech, Polish, and Spanish companies are exhibiting increasingly sophisticated operations and scale, demonstrating that the local ecosystem is developing robust capabilities. This emergence of European Multi-Country Operators (MCOs) represents a strategic shift from the North American MSO model.

Companies like Somai Pharmaceuticals now operate across 12 countries with plans to expand to 20 by year-end, featuring vertically integrated operations spanning manufacturing, cultivation, and distribution. Unlike US MSOs that must rebuild infrastructure in each state due to interstate commerce restrictions, European MCOs benefit from EU-GMP certification that allows products to cross borders legally, enabling one infrastructure to service multiple countries. This structural advantage positions European-based operators to potentially outcompete North American entrants on their home turf.

The Conference Agenda as a Legislative and Investment Crystal Ball

While exhibition floors showcase current capabilities, conference programming reveals the industry’s most pressing challenges and future direction. Cannafest 2025 features free professional conference programming throughout the event, with sessions addressing legal frameworks, medical applications, business strategy, and investment opportunities. The topics that command stage time and expert attention serve as direct indicators of where regulatory battles will be fought and capital deployed in the next 12-24 months.

The Legal & Policy Track: Forecasting Regulation

Legal and policy sessions at Cannafest 2025 heavily feature Germany’s Pillar 2 implementation challenges, cross-border EU trade frameworks, and novel food applications for hemp-derived products. These topics signal exactly where legal and regulatory battles will unfold through 2026. The uncertainty surrounding Germany’s commercial pilot projects—whether they will launch before potential policy reversals following the 2025 elections—creates urgent demand for strategic guidance.

Cross-border trade discussions reflect the fundamental tension in European cannabis markets: EU law theoretically permits free movement of EU-GMP certified cannabis products, yet national-level restrictions create practical barriers. The recent Italian CBD ban under Decree-Law 48/2025, which contradicts European Court of Justice precedent established in the 2020 Kanavape decision, exemplifies this regulatory friction. Conference sessions analyzing these conflicts and pathways to resolution provide crucial intelligence for companies planning pan-European operations.

The Medical & Scientific Track: The Future of Cannabis in Healthcare

Medical and scientific programming at Cannafest reveals the trajectory of Europe’s high-margin medical cannabis sector, which reached $2.59 billion in 2024. Sessions focused on specific therapeutic conditions—particularly chronic pain, neurological disorders, and mental health applications—reflect where clinical evidence and patient demand are strongest. In January 2025, Segra International announced a strategic alliance with GreenBe Pharma to provide European growers access to tissue culture cannabis clones through a regional hub, demonstrating investment in medical supply chains.

The growing focus on minor cannabinoids including cannabigerol (CBG), cannabinol (CBN), and cannabichromene (CBC) represents a significant trend visible in conference programming. The European minor cannabinoids market, valued at approximately $10.2 billion in 2025, is expected to grow at a CAGR of 12.41% through 2033. Sessions examining cannabinoid-specific effects—such as CBG for focus or CBN for sleep—signal a maturing consumer base seeking targeted outcomes beyond simple THC potency.

The Business & Investment Track: Following the Money

Business and investment keynotes provide unfiltered insight into the financial health and maturity of the European cannabis ecosystem. Topics such as mergers and acquisitions, international tax law navigation, and capital raising in tight markets reveal the current state of cannabis finance. The shift from growth-at-all-costs strategies that characterized the initial “green rush” toward profitability-focused operations is evident in conference programming.

Discussion of Multi-Country Operators versus Multi-State Operators highlights strategic considerations unique to European markets. The ability to operate across borders with EU-GMP certification fundamentally changes expansion economics compared to the state-by-state rebuild required in North America. Sessions on vertical integration strategies—owning cultivation, manufacturing, distribution, and retail—reflect lessons learned from mature North American markets where non-integrated players struggled as prices compressed.

| Category | Multi-State Operators (MSOs) | Multi-Country Operators (MCOs) |

| Geographic Focus | Operate within multiple U.S. states | Operate across multiple countries (e.g., U.S., Canada, Germany, Australia) |

| Regulatory Complexity | Navigate varying state-level legalization and licensing systems within one national framework (U.S.) | Face distinct national frameworks, requiring adaptation to international treaties, import/export laws, and cross-border compliance |

| Licensing Strategy | Vertical integration in cultivation, processing, and retail across several states | Build global partnerships, joint ventures, or subsidiaries to gain local market access |

| Market Drivers | Driven by domestic legalization pace, state-by-state rollouts, and consolidation trends | Driven by international medical cannabis growth, export potential, and harmonization under evolving global standards |

| Supply Chain Design | Regionalized supply chain networks within the U.S.; products cannot cross state lines due to federal restrictions | Globalized supply chain with inter-country trade flows, centralized cultivation in low-cost regions (e.g., Colombia) and export to high-margin markets |

| Capital Structure | Typically U.S. private or Canadian public listings (CSE, OTC, NASDAQ) | Often listed in global exchanges (TSX, ASX, LSE) to access international capital and investors |

| Compliance & Standards | Focused on state cannabis control boards (Metrc tracking, ASTM standards) | Must align with international GMP / EU-GMP, ISO, and sometimes WHO pharmaceutical standards |

| Product Focus | Predominantly recreational and medical cannabis within the U.S. | Typically medical cannabis, wellness, or export-grade flower and oil |

| Distribution Model | Dispensary networks, local delivery, and brand licensing within states | Pharmaceutical channels, pharmacies, distributors, and emerging adult-use retail in legal countries |

| Risk Exposure | U.S. federal illegality risk; limited access to banking and interstate commerce | Political, regulatory, and currency risks across jurisdictions |

| Strategic Growth Path | Consolidate within the U.S. market to capture early federal legalization upside | Expand globally through strategic partnerships and regional cultivation/export hubs |

| Examples | Curaleaf, Trulieve, Green Thumb Industries (GTI), Cresco Labs | Tilray Brands, Aurora Cannabis, Canopy Growth (international arm), InterCure, Clever Leaves |

Strategic Comparison: Multi-Country vs. Multi-State Operators

Product Innovation as a Clue to Emerging Consumer Demand

The sophistication and prevalence of value-added cannabis products displayed at Cannafest 2025 provides crucial signals about market maturity. Early-stage markets typically focus on dried flower, while mature markets feature diverse product portfolios including concentrates, edibles, beverages, topicals, and precision delivery systems. Cannafest’s exhibition of hemp cosmetics, textiles, food products, and vaporization technology alongside traditional smoking accessories demonstrates this evolution.

Cannabis Beverages and Edibles

The European cannabis edibles market is projected to grow at a CAGR of 30.0% from 2025 to 2032, with Germany leading due to its robust medical cannabis program and progressive stance toward adult-use legalization. The standard cannabis edibles market reached $27.8 billion in 2025 globally, with Europe representing the fastest-growing regional market. Whether exhibitors at Cannafest showcase scalable, professionally branded edible and beverage products versus novelty items indicates the shift from legacy market dynamics to modern CPG landscapes.

Global consumer packaged goods companies including AB InBev and Diageo have made significant investments in cannabis-infused beverages, while Coca-Cola and Constellation Brands continue exploring opportunities. The 2023 NCIA report documented unprecedented edibles sales growth from 2020-2022, with gummies emerging as the leading category and prominent brands like Wyld and Kiva Confections expanding across legal markets. Products focused on micro-dosing and wellness are gaining particular popularity, addressing stress, sleep disorders, and chronic pain.

The Wellness Angle: Minor Cannabinoids & Terpenes

The exhibition of products explicitly marketing minor cannabinoids for specific effects represents a pivotal market development. The global minor cannabinoids market is experiencing significant growth driven by increasing awareness of therapeutic benefits and expanding applications across pharmaceuticals, nutraceuticals, cosmetics, and functional foods. Germany, the United Kingdom, France, and Spain are emerging as key players in European minor cannabinoids research and commercialization.

Innovation in extraction and purification techniques is expanding the availability and affordability of minor cannabinoids, which typically range from 0.1% to 5% concentration in cannabis plants. Products featuring cannabigerol (CBG) and cannabichromene (CBC) are expected to be the most prominent in the market, with therapeutic applications spanning anti-inflammatory, neuroprotective, and anxiolytic effects. This specialization indicates a consumer base moving beyond simple intoxication toward targeted wellness outcomes.

Packaging, Delivery, and Dosage Tech

Packaging innovation displayed at Cannafest provides critical indicators for both medical market direction and consumer values. European markets have long been at the forefront of sustainable packaging innovation, with regulations and consumer demands pushing brands toward greener solutions. The EU’s Packaging and Packaging Waste Directive establishes consistent recycling targets and material requirements across member states, creating a more standardized compliance landscape than the fragmented US market.

Sustainability emphasis is particularly pronounced in European cannabis packaging, with heavy focus on recycled, biodegradable, and minimalist designs that reflect consumer environmental values. Hemp-based packaging has gained significant traction across EU markets, offering cannabis brands a naturally aligned solution with excellent durability while maintaining biodegradability. Mycelium-based packaging using fungal roots to create protective elements that completely break down in home compost systems shows particular promise for fragile cannabis products.

For medical applications, innovations in metered-dose inhalers, precision tinctures, and pharmaceutical-grade delivery systems demonstrate the sector’s movement toward medical legitimacy. EU-GMP certification requirements ensure strict quality control, safety standards, and traceability that differentiate European medical cannabis from recreational products. The presence of these precision delivery technologies at Cannafest signals maturation of the medical market and opportunities for pharmaceutical-adjacent positioning.

Strategic Takeaways: What This Means for Your Global Cannabis Business

Market Entry: Partner, Acquire, or Build?

The prevalence of strong local European players—particularly Multi-Country Operators with established EU-GMP certification and cross-border distribution capabilities—fundamentally shapes viable entry strategies for North American firms. The MCO model’s structural advantages, where one infrastructure can service multiple countries through EU-GMP certification, creates formidable competitive moats. North American companies face a critical decision: attempt to replicate MCO capabilities through ground-up builds, acquire existing European operators with established infrastructure, or pursue partnership models that leverage local expertise.

Recent trends suggest partnerships and acquisitions dominate successful entry strategies, with North American investment in EU cannabis operations exceeding $600 million. Companies like Curaleaf, Tilray, and Aurora have pursued hybrid approaches—acquiring cultivation and distribution assets while building brand presence through partnerships. The capital-intensive nature of achieving EU-GMP certification and navigating diverse national regulations favors working with established European partners over independent market entry.

Product-Market Fit is Everything

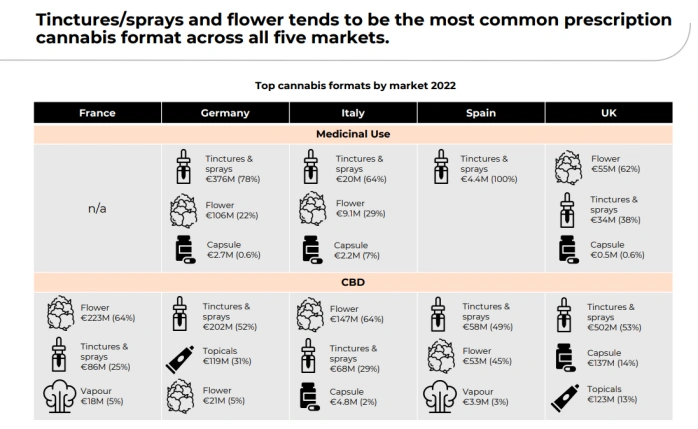

A critical insight from Cannafest exhibitor and product trends is that THC-heavy brands successful in North American recreational markets may face significant adaptation requirements in European contexts. The European cannabis market demonstrates stronger focus on wellness applications, medical precision, and specific therapeutic outcomes compared to North American recreational markets emphasizing potency and novel consumption experiences. The average THC content of herbal cannabis in the European Union was 11% in 2023—roughly half the concentration of cannabis resin at 23%—reflecting different consumption patterns and regulatory frameworks.

The $12.65 billion projected European medical cannabis market by 2033 dwarfs near-term recreational opportunities, given EU restrictions on commercial adult-use sales and the slow pace of Pillar 2 implementation in Germany. Products must emphasize medical applications, therapeutic benefits, quality assurance, and pharmaceutical-grade manufacturing to succeed in European markets. The growing emphasis on minor cannabinoids, precision dosing, and specific condition targeting visible at Cannafest reflects this medical and wellness orientation.

Compliance is the Moat

The single greatest challenge and opportunity in European cannabis markets is navigating the fragmented regulatory landscape. While EU directives provide some harmonization—particularly around GMP certification for medical products—national-level variations in possession limits, cultivation rules, product restrictions, and import/export requirements create complex compliance matrices. Italy’s April 2025 emergency CBD ban under Decree-Law 48/2025, despite contradicting ECJ precedent, demonstrates that regulatory risk remains substantial even in established markets.

Deep understanding of packaging regulations, labeling requirements, child-resistance standards, and cross-border trade restrictions functions as a competitive moat protecting companies with compliance expertise. European packaging regulations emphasize sustainability, recyclability, and extended producer responsibility far more than North American frameworks, requiring different material choices and design approaches. Companies that master these requirements—particularly around EU-GMP certification for medical products and diverse national retail standards—gain significant advantages over competitors struggling with compliance.

The Supply Chain Imperative

A crucial question emerging from Cannafest’s exhibitor landscape is: where will companies source packaging, hardware, and ancillary products that meet diverse EU standards while supporting sustainability commitments? European consumers prioritize eco-friendly packaging solutions significantly more than North American counterparts, with sustainability often outweighing convenience considerations. Hemp-based packaging, mono-material designs that facilitate recycling, and minimalist approaches that reduce material usage represent European best practices increasingly visible at industry events.

Child-resistant packaging requirements vary significantly across European jurisdictions, yet must be balanced with sustainability goals and consumer experience expectations. Navigating these competing requirements demands supply chain partners with deep European market expertise and established relationships with compliant manufacturers. The companies that establish robust European supply chains—capable of delivering compliant, sustainable, and cost-effective packaging and hardware across multiple jurisdictions—will capture disproportionate value as markets scale.

The Verdict for 2025 and Beyond

The verdict from Cannafest Prague 2025 is clear: the European cannabis market is rapidly shifting from infrastructure build-out to brand development, driven by Germany’s legalization catalyst and the Czech Republic’s progressive reforms, with a strong undercurrent of medical innovation and distinct consumer preferences for wellness applications and sustainable practices. The emergence of sophisticated European Multi-Country Operators with EU-GMP certification and cross-border capabilities challenges assumptions about North American dominance, while regulatory fragmentation creates both barriers and opportunities for companies with compliance expertise.

Cannafest functions as an indispensable strategic planning tool precisely because it concentrates these diverse market signals—exhibitor composition, conference discourse, product innovation, and geopolitical context—into a three-day intensive snapshot of European cannabis evolution. The exhibitor landscape reveals capital flows and capability development; the conference agenda forecasts regulatory battles and investment priorities; product innovations signal emerging consumer demands; and the geopolitical context frames opportunities and constraints.

Ghettopac, the cannabis packaging division of Jarsking Packaging, will be exhibiting at Cannafest Prague 2025, showcasing the latest compliance-focused packaging solutions for the European market. With over 20 years of manufacturing expertise in packaging and a hybrid supply chain model, Ghettopac offers child-resistant containers, sustainable packaging options, and EU-compliant designs tailored to meet the complex regulatory requirements across European jurisdictions.