Market Analysis and Growth Projections

Current Market Size and Projections

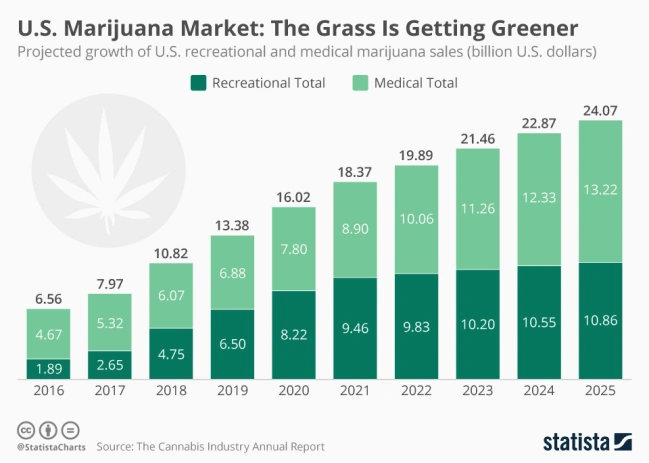

The cannabis concentrate market demonstrates remarkable growth momentum across multiple analytical perspectives, with consistent projections indicating sustained expansion through the next decade. Current market valuations and future projections vary among research organizations, but all point toward significant opportunity.

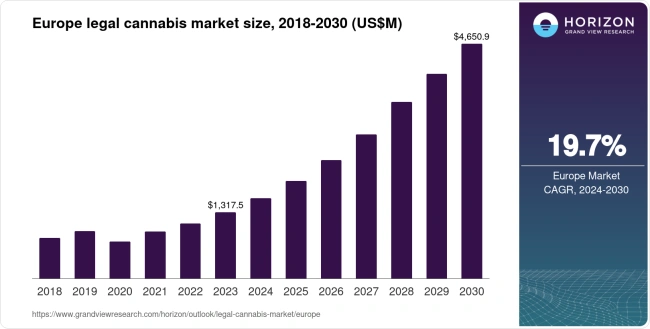

Global Market Valuation shows substantial current value and explosive growth potential. The global cannabis concentrate market is expected to grow at a CAGR of 17.4% from 2025 to 2030, with North America leading growth alongside emerging markets in Europe and LATAM. Alternative analysis suggests the global cannabis extract market was valued at USD 10.3 billion in 2024 and is projected to reach USD 28.5 billion by 2032, growing at a CAGR of 15.7%.

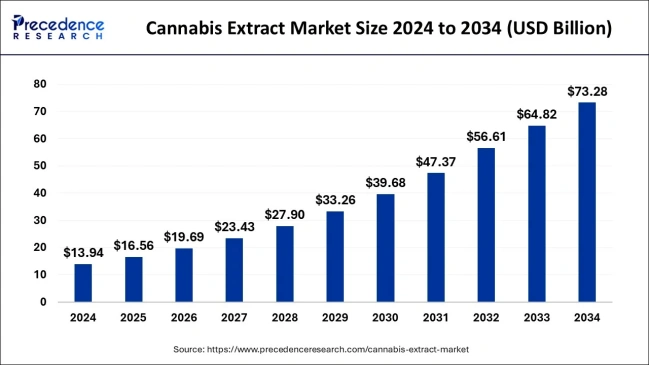

Research from Precedence Research indicates even higher growth potential, with the global cannabis extract market size calculated at USD 16.56 billion in 2025 and forecasted to reach around USD 73.28 billion by 2034. These varying projections reflect the dynamic nature of this emerging industry and the challenges inherent in forecasting rapidly evolving markets.

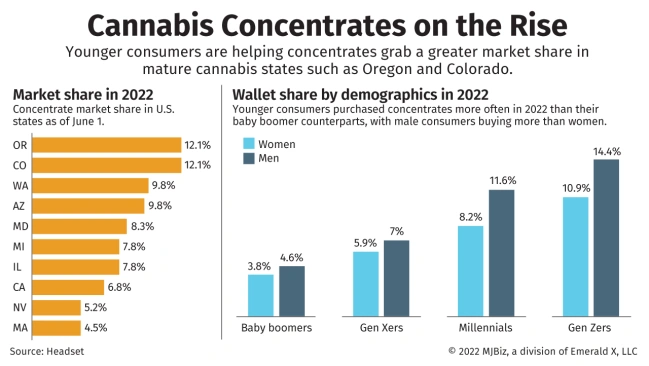

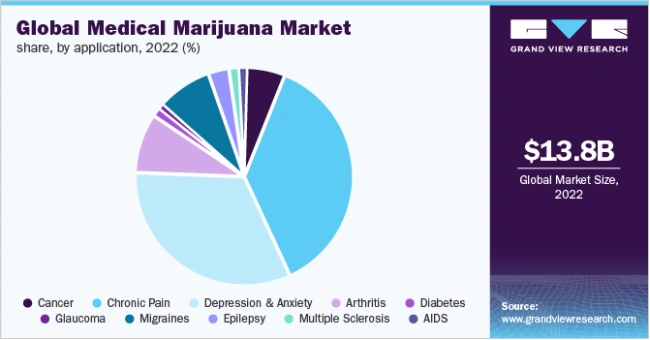

Regional Market Leadership remains concentrated in North America due to progressive legal frameworks and established infrastructure. However, Europe and Asia-Pacific are emerging as high-growth regions with evolving regulations. The medical segment accounts for over 60% of current market value, particularly for chronic pain management and neurological disorders, while recreational demand is accelerating faster in legalized markets, with product innovation in edibles and vape concentrates driving premiumization.

Market Drivers and Growth Factors

Multiple convergent factors drive the sustained growth of the cannabis concentrate market, creating a compelling investment environment for industry participants.

Legalization and Regulatory Changes represent the primary catalyst for market expansion. Currently, twenty-four states plus the District of Columbia have approved measures to legalize cannabis for adult recreational use, while thirty-eight states, the District of Columbia and five US territories have legalized the use of cannabis for medical use in some form. This expanding legal framework creates new markets and opportunities for concentrate producers.

Consumer Preference Shifts toward higher potency and convenience drive concentrate adoption. Concentrates offer several advantages over traditional flower consumption, including higher potency and precision dosing capabilities, discreet and convenient consumption methods, and expanded therapeutic applications. Medical applications particularly benefit from concentrate formats, as they enable precise dosing for chronic pain, epilepsy, and cancer symptoms.

Technology and Innovation Drivers continue advancing product quality and production efficiency. Advanced extraction methods are improving quality and safety, while investment from pharmaceutical and wellness companies brings additional resources and expertise to the industry. The expanding product variety and therapeutic applications create new market segments and consumer adoption opportunities.

Key Market Players

The cannabis concentrate market features both established multi-state operators and emerging specialized companies competing across different market segments, creating a dynamic competitive landscape characterized by rapid consolidation, vertical integration strategies, and technological innovation. This market structure reflects the industry’s evolution from fragmented regional players to sophisticated enterprises capable of operating across multiple jurisdictions while maintaining compliance and quality standards.

Trulieve Cannabis Corp. has emerged as a market leader, holding 11% of the US market share in 2023 through aggressive expansion and vertical integration across cultivation, processing, and retail operations. The company operates 225 dispensaries and 15 cultivation and processing facilities across multiple states, establishing a formidable competitive position through scale and operational efficiency. Trulieve’s success stems from its seed-to-sale vertical integration model, which provides quality control throughout the supply chain while maximizing profit margins on concentrate products. The company’s concentrate operations utilize multiple extraction methodologies including CO2, ethanol, and hydrocarbon extraction, enabling production of diverse product lines targeting both medical and recreational market segments.

Trulieve’s market dominance reflects strategic advantages including first-mover benefits in key markets, established cultivation capacity, and sophisticated extraction facilities capable of producing premium concentrates at scale. The company’s retail footprint provides direct access to consumers, enabling better market intelligence and product development aligned with consumer preferences. Their concentrate portfolio includes live resin, rosin, shatter, wax, and distillate products, positioning them across all major product categories.

Canopy Growth Corporation maintains a strong position in international markets, offering branded high-quality flower, oil and extract products under the Company’s recognized Spectrum Therapeutics and Canopy Medical brands. The company focuses on medical cannabis in Australia and Europe while maintaining operations in multiple business segments. Canopy Growth’s international focus provides diversification benefits and exposure to emerging markets with significant growth potential, particularly in medical cannabis applications where concentrates offer precise dosing capabilities essential for therapeutic use.

Other significant players include Aurora Cannabis, Tilray, Cronos Group, Aphria Inc., and Medical Marijuana Inc., each maintaining distinct competitive strategies and market positioning. Aurora Cannabis has focused on large-scale cultivation and international expansion, particularly in European medical cannabis markets where concentrates serve pharmaceutical applications. Tilray has pursued strategic acquisitions and product diversification, building a comprehensive portfolio including premium concentrate products targeting both medical and recreational consumers.

Cronos Group differentiates through technology partnerships and innovative product development, including advanced extraction technologies and novel delivery systems for concentrate consumption. The company’s strategic investments in extraction technology and research and development position it for next-generation product innovation. Medical Marijuana Inc. maintains focus on medical applications and CBD-focused concentrates, serving the wellness market and pharmaceutical partnerships.

The competitive landscape includes specialized extraction companies and technology providers that serve both contract manufacturing and equipment supply roles. These companies often provide technical expertise and specialized equipment to larger operators while developing proprietary extraction methods and processing technologies. Contract extraction services enable smaller cannabis companies to access concentrate markets without significant capital investment in extraction facilities.

Technology providers supply extraction equipment, automation systems, and quality control technologies that enable consistent product quality and operational efficiency. These companies play crucial roles in industry standardization and technological advancement, driving innovation in extraction methods and product development.

The competitive landscape continues evolving as the industry matures and consolidates, with larger operators acquiring smaller companies to expand market presence and gain specialized capabilities. This consolidation trend reflects economies of scale benefits, regulatory compliance advantages, and capital requirements for multi-state operations. Emerging companies must differentiate through specialization, innovation, or market niche focus to compete effectively against established operators with significant resources and market presence.

Industry Applications and Use Cases

Medical Applications

Cannabis concentrates demonstrate significant therapeutic potential across numerous medical conditions, with growing clinical evidence supporting their efficacy in various treatment protocols.

Therapeutic Benefits and Medical Research continue expanding the evidence base for concentrate applications. According to industry research, cannabis extract can address a variety of health conditions, ranging from chronic pain to anxiety, epilepsy, and sleep disorders. The concentrates’ high cannabinoid content enables precise dosing protocols essential for medical applications.

Specific Medical Applications include treatment for chronic pain management, where concentrates offer advantages over traditional pharmaceuticals. Cannabis contains over 100 different cannabinoids, each exhibiting unique effects on the human body. THC is known for its psychoactive properties, offering pain relief and stimulating appetite, while CBD is praised for its non-psychoactive qualities that can potentially reduce anxiety and inflammation.

Research and Development Landscape shows increasing institutional involvement in cannabis research. Cannabis Bioscience International Holdings reports conducting clinical trials for hemp-derived cannabidiol (CBD) medical products and notes that CBD derived from hemp containing less than 0.3% of tetrahydrocannabinol (THC) was legalized at the federal level by the Agriculture Improvement Act of 2018.

Recreational and Consumer Markets

The recreational cannabis concentrate market demonstrates different consumption patterns and preferences compared to medical applications, driving innovation in product development and marketing approaches.

Consumption Methods and Preferences vary significantly among recreational users. Dabbing and vaporization remain popular among experienced users seeking immediate effects and high potency. Edible infusion offers discreet consumption for users preferring longer-lasting effects. Flower enhancement allows traditional smokers to increase potency without changing consumption habits.

Consumer Education and Market Maturation play crucial roles in expanding the recreational concentrate market. As markets mature, consumers become more sophisticated in their product preferences, demanding higher quality and consistency. This trend reduces stigma through education and awareness while enabling premium product positioning and brand differentiation.

Manufacturing and Technology Innovations

Advanced Extraction Technologies

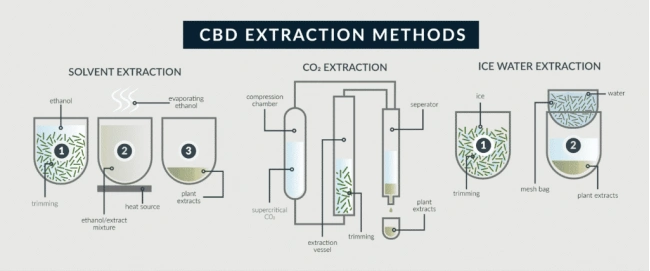

The cannabis concentrate industry continues advancing extraction technologies to improve efficiency, product quality, and safety standards. These innovations directly impact product consistency, yield optimization, and regulatory compliance.

Next-Generation Equipment and Processes incorporate sophisticated automation and precision controls. The industry has witnessed the development of continuous and closed-loop equipment technologies capable of meeting stringent safety guidelines while optimizing throughput. Advancements in equipment design, including centrifugal systems and open-column architectures, have further enhanced yield consistency and operational efficiency.

Emerging Technologies include polymeric nanoparticles and nanofibers for enhanced bioavailability and specialized delivery systems and formulation technologies. These innovations enable manufacturers to create products with improved therapeutic efficacy and consumer experience.

Quality Control and Standardization requirements drive technological advancement across the industry. Laboratory testing and batch tracking requirements ensure product consistency, while consistency in potency and purity standards builds consumer confidence and regulatory compliance.

Product Development Trends

Innovation in concentrate formulations reflects evolving consumer preferences and advancing scientific understanding of cannabinoid interactions and delivery mechanisms.

Innovation in Concentrate Formulations includes development of cannabinoid glycosides and enhanced water solubility products. Innovations in nanotechnology are also influencing the market by improving the bioavailability of cannabis extracts. By reducing cannabinoids to nano-sized particles, manufacturers can create water-soluble extracts that are more easily absorbed by the body, leading to faster onset and more predictable effects.

Delivery System Advancement encompasses transdermal applications and topical formulations for targeted therapeutic effects. Food and beverage integration technologies enable new product categories and consumption methods, expanding market reach beyond traditional cannabis consumers.

The industry also sees growing interest in hemp extract-based alcohol replacement technologies and other innovative applications that leverage concentrate technology for adjacent markets.

Regulatory Compliance and Quality Control

State-Specific Requirements

Cannabis concentrate manufacturers must navigate varying regulatory frameworks across different jurisdictions, each with unique requirements for testing, labeling, and quality assurance.

Testing and Laboratory Requirements represent critical compliance elements across all legal markets. In Washington State, all cannabis products sold in dispensaries must undergo testing for potency and contaminants (e.g., pesticides, mold, and residual solvents) at state-certified laboratories to ensure they meet health and safety standards before they reach consumers.

California maintains similarly rigorous standards, requiring that cannabis retailers may only sell cannabis products that were received by the retail licensee from a licensed distributor and that the goods must have undergone appropriate laboratory testing, and the batch number labeled on the package of cannabis goods must match the batch number on the corresponding certificate of analysis for regulatory compliance testing.

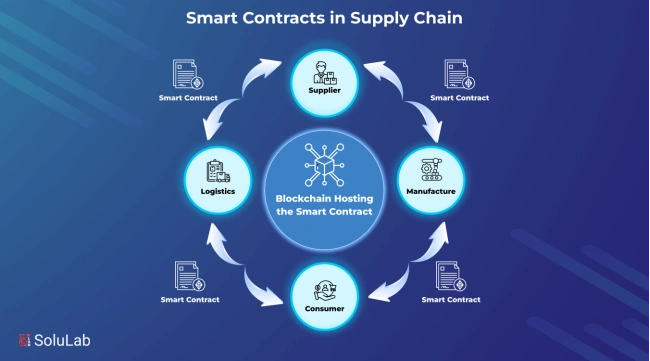

Security and Tracking Requirements ensure product accountability throughout the supply chain. Washington requires all participants in the Washington cannabis industry to use the state’s seed-to-sale tracking system, called the Marijuana Tracking System (the “MTS”), to monitor the movement of cannabis products from cultivation to sale. California mandates similar tracking protocols along with comprehensive security measures.

International Compliance

As cannabis markets expand globally, concentrate manufacturers must understand international regulatory frameworks, particularly in emerging markets like Europe and medical cannabis programs worldwide.

European Market Requirements demonstrate the complexity of international compliance. In Germany, medical cannabis products imported under an import license issued under the MedCanG and AMG permits are sold exclusively to pharmacies for final dispensing to patients on a prescription basis as ‘magistral preparations’. All medical cannabis products imported to Germany must derive from plant material cultivated in a country whose regulations comply with the Narcotic Convention and must comply with the relevant monographs described in the German and European pharmacopeias.

Manufacturing Standards for international markets require EU-GMP certification for companies seeking to export to European markets. As a prerequisite to obtaining a German import license, the supplier must grow and harvest in compliance with EU-GACP-Guidelines and manufacture in compliance with EU-GMP-Guidelines and certifications.

Challenges and Future Outlook

Industry Challenges

Despite remarkable growth, the cannabis concentrate industry faces several significant challenges that could impact future development and market expansion.

Regulatory Uncertainty and Compliance Costs remain primary concerns for industry participants. Discrepancies in THC limits, testing requirements, and product classifications across jurisdictions create operational complexities for extract manufacturers. These regulatory inconsistencies increase compliance costs and complicate business operations for multi-state and international companies.

Banking and Financial Service Limitations continue restricting industry growth and operations. Many financial institutions remain hesitant to provide services to cannabis businesses due to federal legal uncertainty, creating challenges for capital access and routine business operations.

Market Competition and Pricing Pressures intensify as markets mature and new participants enter. The challenge lies in balancing premium positioning vs. commoditization trends while maintaining quality differentiation in saturated markets. As markets become more competitive, maintaining profit margins while meeting increasing quality expectations requires continuous innovation and operational efficiency.

Future Opportunities

The cannabis concentrate industry presents numerous opportunities for growth and innovation as markets continue expanding and evolving, driven by technological advancement, regulatory evolution, and changing consumer preferences that create new avenues for business development and market expansion.

Emerging Market Segments

Emerging Market Segments offer significant potential for industry expansion beyond current domestic markets. International expansion and export opportunities present particularly attractive prospects as more countries implement medical cannabis programs, with markets like Germany, Australia, and emerging European Union nations creating demand for high-quality concentrate products. These international markets often prioritize pharmaceutical-grade concentrates with consistent potency and purity standards, creating opportunities for companies with advanced extraction capabilities and quality control systems.

Pharmaceutical integration and FDA approval pathways could unlock substantial new markets and applications for concentrate products, particularly as cannabis moves toward potential federal rescheduling. This integration would enable concentrate manufacturers to develop standardized pharmaceutical formulations, clinical trial applications, and prescription-grade products that serve traditional healthcare markets while leveraging existing extraction expertise and manufacturing capabilities.

Technology Integration Prospects

Technology Integration Prospects encompass revolutionary advances that could transform industry operations and consumer experiences. IoT and blockchain for supply chain transparency enable real-time tracking of concentrate production, quality monitoring throughout distribution, and consumer access to comprehensive product histories. These technologies support regulatory compliance, quality assurance, and consumer confidence while reducing operational costs and improving efficiency.

Personalized medicine and precision dosing applications represent the convergence of cannabis science with healthcare technology, enabling customized concentrate formulations based on individual patient needs, genetic profiles, and treatment responses. These technological advances could revolutionize how concentrates are produced, distributed, and consumed while improving safety and efficacy through data-driven treatment protocols and automated dosing systems.

Sustainable Innovation

The industry also shows potential for sustainable practices and environmental innovation, as consumers increasingly demand environmentally responsible products and processes. This includes renewable energy integration in extraction facilities, sustainable packaging solutions, carbon-neutral cultivation practices, and waste reduction technologies that align with broader environmental consciousness while potentially reducing operational costs and improving brand positioning in environmentally conscious market segments.

Conclusion

The cannabis concentrate industry represents one of the most dynamic and rapidly growing segments within the global cannabis market. With projected growth rates exceeding 15% annually and market valuations reaching billions of dollars, concentrates have evolved from niche products to mainstream cannabis offerings serving both medical and recreational consumers.

Key Takeaways for Industry Stakeholders include the critical importance of maintaining regulatory compliance while investing in quality control and technological innovation. The market growth trajectory and investment opportunities remain compelling, but success requires careful navigation of regulatory complexities and competitive pressures. Building consumer trust through compliance and quality represents essential foundation for long-term success.

The Evolving Landscape of Cannabis Concentrates demonstrates the industry’s transition from niche product to mainstream acceptance. As markets mature and regulatory frameworks stabilize, future integration with healthcare and wellness industries appears increasingly likely. The convergence of pharmaceutical-grade manufacturing standards with cannabis concentrate production suggests significant opportunities for medical applications and mainstream acceptance.

Strategic Considerations for Businesses Entering the Space emphasize the importance of vertical integration, technological investment, and regulatory expertise. Companies that can successfully balance innovation with compliance while maintaining operational efficiency are best positioned to capitalize on the industry’s continued growth. The concentrate market’s evolution from artisanal production to sophisticated manufacturing reflects the broader maturation of the cannabis industry and its integration into legitimate business and healthcare sectors.

As legalization continues expanding globally and scientific understanding of cannabinoids advances, cannabis concentrates are poised to play an increasingly important role in both therapeutic medicine and consumer wellness markets. The industry’s future success will depend on maintaining high quality standards, ensuring regulatory compliance, and continuing technological innovation while building consumer confidence and mainstream acceptance.