Cannabis topicals represent the perfect convergence of wellness, beauty, and therapeutic innovation—positioning themselves as the cannabis category’s most accessible entry point for mainstream consumers. Unlike inhalable or edible cannabis products, topicals offer localized relief without psychoactive effects, making them appealing to demographics traditionally hesitant about cannabis consumption. This unique positioning has catalyzed remarkable market growth, with projections indicating the cannabis topicals market could reach $1.3 billion by 2025, growing at rates that consistently outpace the broader cannabis industry.

The topicals category serves as a critical bridge between traditional wellness products and cannabis therapeutics, attracting consumers who prioritize natural pain relief, skincare benefits, and targeted therapeutic applications. This format drives both niche growth and consumer loyalty by delivering immediate, localized benefits while avoiding the regulatory complexities and consumer apprehensions associated with psychoactive cannabis products.

This comprehensive analysis examines the cannabis topicals landscape through six critical lenses: product categorization and consumer applications, cannabinoid formulation strategies, brand positioning trends, packaging performance requirements, compliance frameworks, and emerging innovation opportunities. From balms targeting athletic recovery to luxury spa-grade skincare lines, cannabis topicals represent a sophisticated market segment where formulation science, packaging innovation, and consumer trust intersect to create sustainable competitive advantages.

Defining Cannabis Topicals in the Current Market

The cannabis topicals category encompasses products designed for external application to skin, hair, or nails, containing cannabinoids as active ingredients. However, this seemingly straightforward definition masks significant complexity in product classification, regulatory treatment, and consumer expectations across different market channels.

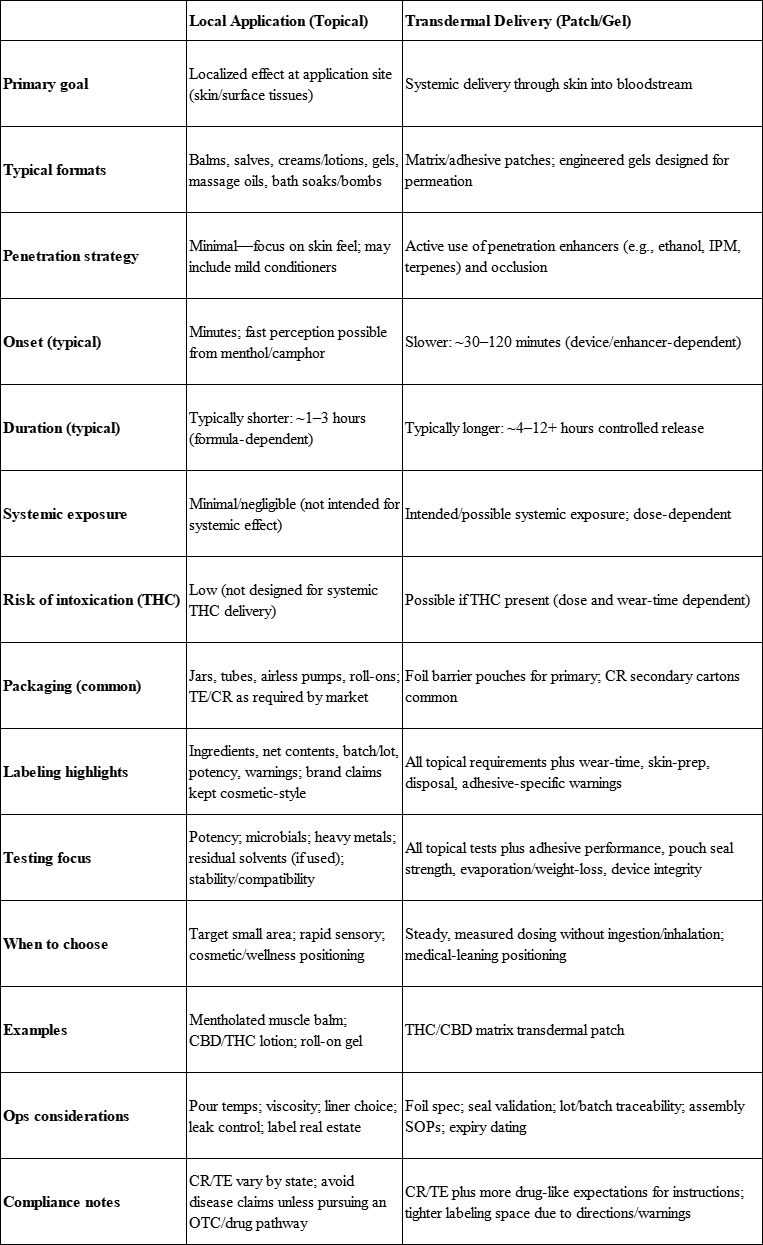

Local Application vs. Transdermal Delivery

The industry distinguishes between topical products that provide localized effects and transdermal products designed to penetrate skin layers and enter systemic circulation. Traditional topicals—including most balms, creams, and salves—interact primarily with cannabinoid receptors in the skin’s surface layers, providing targeted relief without entering the bloodstream. Conversely, transdermal patches and specialized gels are formulated to achieve systemic delivery, offering controlled-release cannabinoid dosing over extended periods.

This distinction carries profound implications for product development, consumer messaging, and regulatory compliance. Topical products can generally make localized benefit claims while avoiding the heightened scrutiny applied to products with systemic effects.

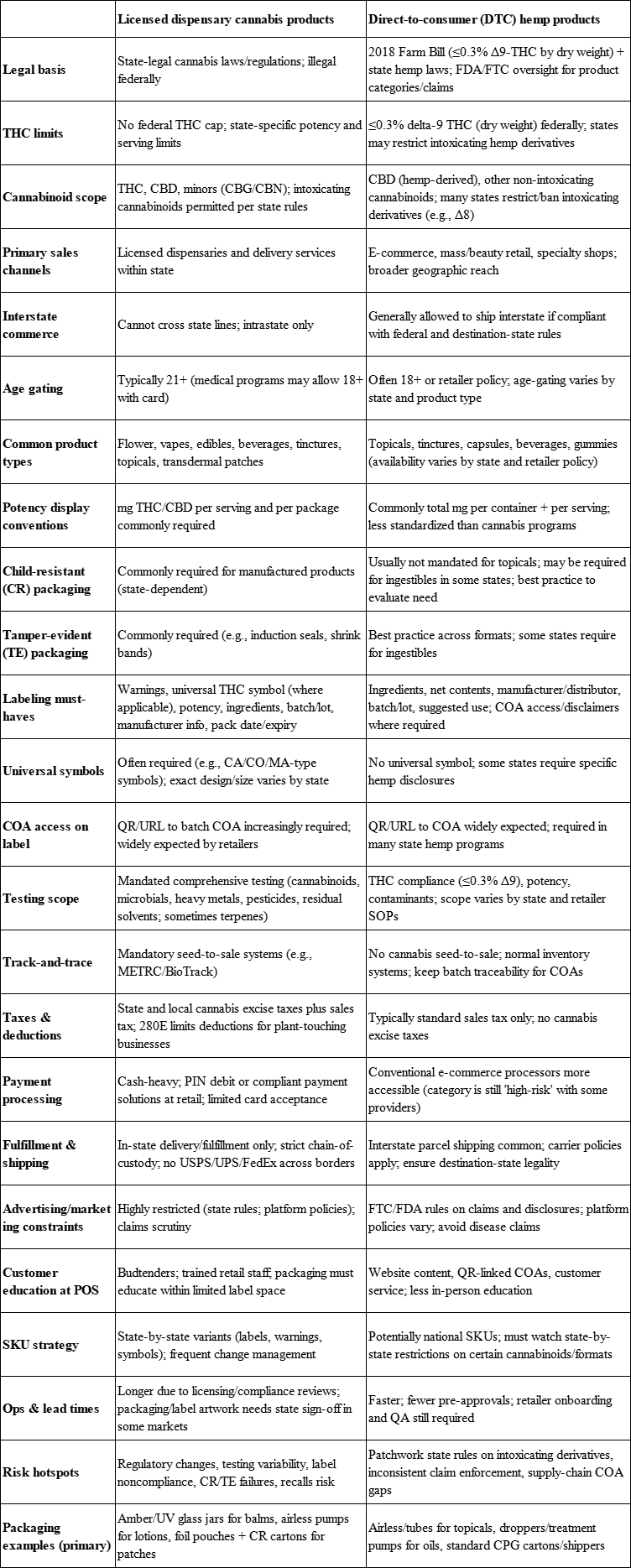

Regulatory Impact on Product Classification

Varying cannabinoid regulations fundamentally shape product development and market positioning. Hemp-derived CBD products with less than 0.3% THC can be sold through conventional retail channels in most states, while THC-containing topicals require licensed dispensary distribution. This regulatory divide creates two distinct development pathways: hemp-derived products targeting mainstream wellness markets and cannabis topicals serving medical and adult-use consumers seeking higher potency formulations.

State-specific regulations add additional complexity. California mandates child-resistant packaging and universal cannabis symbols for all THC-containing topicals, while New York requires a minimum 25% post-consumer recycled content in packaging materials. These requirements directly influence formulation choices, packaging design, and distribution strategies

Channel-Driven Development Approaches

The distribution channel profoundly influences product development priorities. Licensed dispensary products can leverage higher THC concentrations, full-spectrum cannabinoid profiles, and therapeutic positioning, while direct-to-consumer hemp products must navigate FDA restrictions on health claims and focus on general wellness benefits. This channel distinction drives divergent approaches to formulation, packaging, and consumer education strategies across the topicals category.

Product Landscape: Formats & Use Cases

Balms & Salves

High-viscosity, occlusive formulations represent the foundation of the cannabis topicals category, offering maximum ingredient concentration and extended skin contact time. These products typically feature beeswax and coconut oil bases that create protective barriers while facilitating slow cannabinoid absorption. Target consumers include individuals seeking concentrated relief for chronic pain conditions, arthritis, and localized inflammation.

Common fill weights range from 15ml to 60ml containers, with 30ml representing the most popular consumer size point. Dispensary pricing typically ranges from $25-60 per unit, depending on cannabinoid concentration and brand positioning. Glass jars dominate premium segments, while child-resistant plastic containers serve value-focused markets. The occlusive nature of these formulations makes them particularly suitable for overnight applications and extended therapeutic use.

Creams & Lotions

Cream and lotion formulations prioritize rapid absorption and sensorial appeal, differentiating through texture, fragrance, and application experience. These products typically incorporate emulsifiers and penetration enhancers that facilitate faster cannabinoid delivery compared to balm-based alternatives. Consumer preference increasingly favors non-greasy formulations that absorb quickly without residue, particularly for daytime use applications.

Packaging choices reflect volume and usage patterns, with pump dispensers preferred for mid-to-high-volume SKUs (100ml+) and tubes favored for travel-sized and trial products (15-50ml). Pump systems offer dosing control and contamination prevention while maintaining product integrity over extended use periods. Fragrance positioning varies significantly, from unscented medical formulations to lavender and eucalyptus variants targeting spa and wellness markets.

Gels & Roll-Ons

Single-hand application formats address active lifestyle consumers seeking convenient, portable pain relief solutions. Gel formulations often incorporate menthol, camphor, or cooling agents that provide immediate sensory feedback while cannabinoids deliver sustained therapeutic effects. Roll-on delivery systems enable precise application and eliminate hand contact, appealing to consumers using products during physical activities.

Material compatibility becomes critical with menthol and terpene-rich formulations, as certain plastic components can experience stress cracking or chemical interaction over time. Glass rollerball assemblies offer superior compatibility but increase product costs and breakage risks during shipping and consumer use.

Massage Oils & Bath Products

Multi-use positioning creates crossover opportunities between cannabis, spa, wellness, and retail markets. Massage oils leverage carrier oils like coconut, jojoba, and hemp seed oil to deliver cannabinoids while providing traditional massage benefits. Bath products, including bath bombs and soaking salts, offer whole-body wellness experiences that differentiate from targeted pain relief applications.

Bottle selection and leak-proof sealing systems become critical for oil-based products, particularly for e-commerce distribution. Dropper bottles offer precise dosing control, while pump dispensers prevent contamination and enable single-handed operation. UV-resistant glass provides optimal product preservation, though shipping costs and breakage concerns influence packaging material decisions.

Transdermal Patches

Controlled-release delivery systems offer the topicals category’s most sophisticated dosing technology, providing steady cannabinoid release over 8-24 hour periods. Patch technology suppliers have adapted pharmaceutical-grade delivery systems for cannabis applications, incorporating rate-controlling membranes and adhesive systems optimized for cannabinoid delivery.

Primary and secondary packaging integration addresses multiple compliance requirements simultaneously. Individual patch pouches provide tamper-evidence and product protection while enabling precise lot tracking. Secondary cartons accommodate child-resistant requirements while providing labeling space for compliance information and dosing instructions.

Niche & Specialty Products

Specialized applications including personal lubricants represent high-margin opportunities with unique regulatory sensitivities. These products require discreet packaging and distribution strategies while addressing intimate wellness applications that differentiate from mainstream pain relief positioning. Packaging design must balance discretion with compliance requirements, often utilizing minimalist graphics and medical-style labeling approaches.

Cannabinoid & Formulation Considerations

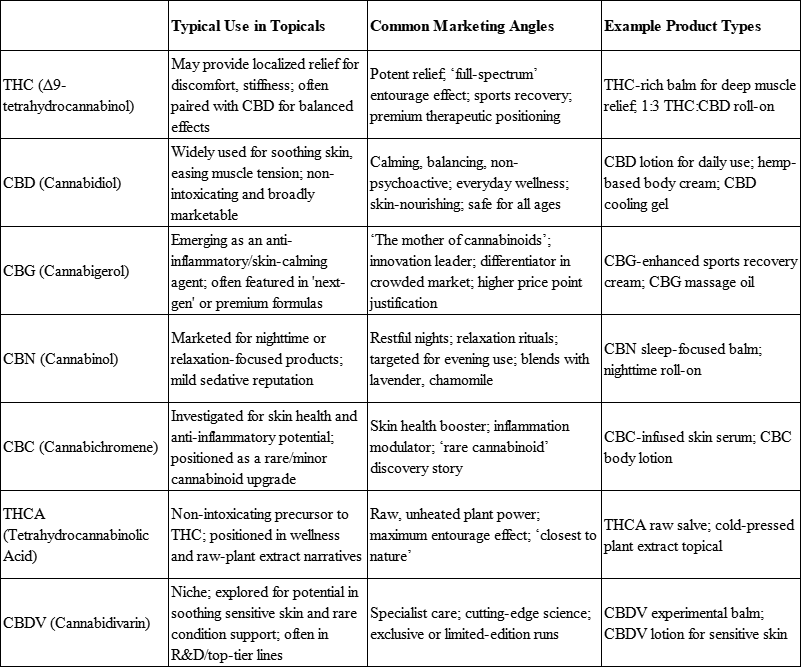

Primary Cannabinoids and Marketing Angles

THC-dominant formulations leverage the cannabinoid’s established analgesic properties, targeting consumers seeking maximum pain relief efficacy. These products typically command premium pricing due to regulatory complexity and restricted distribution through licensed dispensaries. CBD-focused formulations emphasize anti-inflammatory benefits and broader consumer appeal, enabling distribution through conventional retail channels while targeting skincare and general wellness applications.

Minor cannabinoids including CBG and CBN create differentiation opportunities through specialized therapeutic positioning. CBG formulations target inflammatory skin conditions and offer antimicrobial benefits, while CBN products focus on relaxation and sleep-support applications. However, minor cannabinoid sourcing costs can be 5-10x higher than major cannabinoids, significantly impacting formulation economics.

Terpene Integration Strategies

Terpenes function as multifaceted formulation components, serving as aroma agents, penetration enhancers, and therapeutic activity modulators. Beta-caryophyllene directly activates CB2 receptors, enhancing anti-inflammatory effects, while limonene provides penetration enhancement and mood-supportive benefits. Alpha-pinene offers focus-supporting properties and can counterbalance THC’s psychoactive effects in transdermal applications.

Research demonstrates that specific terpene-cannabinoid combinations can enhance therapeutic efficacy by up to 42% compared to isolated cannabinoid formulations. This “entourage effect” drives full-spectrum product positioning and justifies premium pricing for complex formulations versus isolate-based alternatives.

Stability Considerations in Terpene-Rich Environments

Terpene volatility and chemical reactivity create significant formulation stability challenges. High-terpene formulations require specialized packaging materials and storage conditions to prevent degradation and maintain sensorial properties over product shelf life. Accelerated aging studies become critical for establishing expiration dating, particularly for products containing multiple terpene compounds.

Container interaction testing must evaluate terpene compatibility with primary packaging materials, as certain plastic polymers can absorb terpenes or experience stress cracking when exposed to high concentrations. Glass containers offer superior terpene compatibility but increase costs and shipping complexity compared to plastic alternatives.

Brand Landscape & Positioning Trends

The cannabis topicals market showcases distinct brand positioning strategies, each targeting specific consumer segments through differentiated approaches to formulation, packaging, and marketing. Analysis of leading brands reveals how successful companies execute these positioning strategies while building consumer loyalty and market share.

Medical Positioning Lane

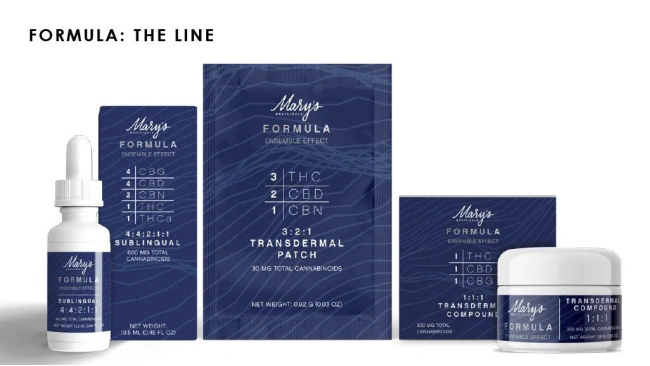

Mary’s Medicinals exemplifies the medical positioning approach, having established itself as the pioneer of cannabis transdermal technology. Founded in 2013, Mary’s Medicinals developed the first transdermal cannabis patch and patented transdermal gel pen technology, positioning itself as an innovation leader in medical cannabis delivery systems.

The brand maintains consistent market leadership in the medical segment, consistently ranking second in California’s topical category from January through April 2025, demonstrating stable demand and strong brand recognition. Their product portfolio centers on transdermal patches with specific cannabinoid ratios designed for targeted therapeutic outcomes, including CBD/THC/CBN 2:3:1 Formula patches for comprehensive relief and CBD/THC 1:1 Relief patches for balanced therapeutic effects.

Mary’s Medicinals leverages pharmaceutical-grade manufacturing processes and emphasizes the science behind transdermal delivery, educating consumers about bioavailability advantages and controlled-release mechanisms. The brand’s packaging utilizes medical aesthetics with clean, clinical design elements that reinforce professional credibility while meeting compliance requirements. Their success demonstrates how medical positioning creates sustainable competitive advantages through technological innovation and educational authority.

Market Performance: Mary’s Medicinals’ top-performing product in April 2025 was the CBD/THC/CBN 2:3:1 Formula Transdermal Patch with sales of 5,285 units, showing significant growth from third position in March to first place in April.

Active Lifestyle Positioning

Papa & Barkley dominates the active lifestyle segment as California’s leading cannabis wellness brand, holding the #1 position in topicals and tinctures categories. Founded by Adam Grossman in 2014, the brand originated from a personal mission to ease his father’s debilitating back pain, creating an authentic narrative that resonates with active consumers seeking natural pain relief solutions.

The brand’s positioning emphasizes “clean, highly effective, natural products” using proprietary solventless, whole-plant infusion processes that appeal to health-conscious consumers. Papa & Barkley differentiates through their exclusive use of fresh-pressed rosin rather than distillate or isolate, creating products with full-spectrum cannabinoids, phytonutrients, and terpenes that deliver enhanced therapeutic effects.

Product Innovation: The brand’s skincare line includes CBD Releaf Body Lotion for daily moisturizing, CBD Releaf Repair Cream for face and neck applications, and CBD Releaf Body Oil for versatile full-body relief. Their 1:3 THC Releaf Body Lotion represents the first THC lotion in California made using fresh-pressed rosin, demonstrating innovation leadership in the active lifestyle segment.

Papa & Barkley’s packaging emphasizes natural, earth-tone aesthetics that reinforce their clean, organic positioning while maintaining compliance requirements. The brand sources cannabis exclusively from Emerald Triangle farmers using organic and regenerative farming principles, supporting sustainability messaging that appeals to environmentally conscious active lifestyle consumers.

Luxury Spa/Skincare Positioning

Lord Jones established the luxury cannabis segment through premium positioning that elevates cannabis products to luxury consumer goods standards. The brand’s aesthetic approach treats cannabis as a sophisticated lifestyle component rather than a medical necessity, targeting affluent consumers seeking premium experiences.

Premium Market Positioning: Lord Jones products command luxury pricing, with individually wrapped dark chocolate chews priced at $5 each and gourmet gumdrops packaged nine to a box targeting the premium confection market. Their topicals line includes sophisticated formulations like CBD-infused acid mantle repair moisturizer with ceramides, hyaluronic acid, and squalene, positioning products to compete with high-end skincare brands.

The brand’s distribution strategy reinforces luxury positioning through exclusive partnerships, including the groundbreaking collaboration with Standard International hotels to open the first hotel-based dispensary in the Standard Hollywood lobby. This partnership creates experiential retail environments that position Lord Jones products within luxury hospitality contexts.

Artistic Collaborations: Lord Jones differentiates through cultural partnerships, including limited-edition collections with Iceland’s Sigur Ros featuring foraged Icelandic berry flavors and “higher healing” recovery workshops at Hollywood Equinox gym. These collaborations position the brand within artistic and wellness culture while creating exclusive product offerings that justify premium pricing.

Packaging Excellence: Lord Jones packaging utilizes sophisticated design elements including minimalist graphics, premium materials, and artistic presentation that positions products as luxury consumer goods rather than medical supplies. The brand’s aesthetic approach enables placement in high-end retail environments and appeals to consumers who value design and presentation quality.

Heritage Apothecary Positioning

Almora exemplifies heritage apothecary positioning through its distinctive visual identity that seamlessly blends traditional influences with modern artisanal aesthetics. The brand’s packaging features warm earth tones and script fonts that convey an authentic, handcrafted look and feel, immediately communicating small-batch production values and cultural authenticity. Drawing inspiration from the majestic Himalayas and the town of Almora where cannabis has been nurtured for decades, the brand positions their products as cultural artifacts that honor traditional cannabis cultivation practices. This approach differentiates Almora from mass-market cannabis brands by creating an emotional connection rooted in historical cannabis wisdom and regional growing traditions.

The brand’s commitment to heritage positioning extends beyond visual aesthetics into their cultivation and processing philosophy, emphasizing “cannabis the way nature intended” through sustainable sun-grown practices. Almora focuses specifically on bringing out the natural terpenes and flavors of their strains, with branding that reflects dedication to preserving botanical authenticity rather than heavy technological manipulation. Their unique fusion of traditional aesthetics with clean, modern design elements creates a distinctive market position that feels both special and deeply rooted in culture and tradition, successfully navigating the challenge of maintaining cultural authenticity while appealing to contemporary consumers and retail environments.

The success of Almora’s heritage positioning demonstrates how cannabis brands can leverage cultural storytelling and traditional aesthetics to command premium pricing through artisanal positioning while building consumer loyalty based on cultural appreciation and authenticity. By positioning their products as continuations of traditional cannabis practices rather than modern innovations, Almora achieves sustainable profitability through premium positioning and deeply engaged consumer communities who value cultural preservation and traditional botanical wisdom, proving that heritage apothecary brands can maintain profitable market presence despite smaller market share compared to mass-market alternatives.

Multi-SKU Strategies vs. Hero Product Focus

Market analysis reveals that successful brands increasingly adopt focused product portfolios rather than extensive line extensions. Papa & Barkley’s success stems from concentrating on topicals and tinctures categories where they can achieve market leadership, rather than diluting brand focus across multiple product categories.

Mary’s Medicinals demonstrates effective hero SKU strategy by focusing innovation resources on transdermal patch technology, creating sustainable competitive advantages through specialized expertise and patent protection. Their market-leading patch formulations generate consistent sales performance while supporting brand differentiation.

Conversely, Lord Jones succeeds with selective diversification, expanding from edibles into topicals only when formulations meet luxury brand standards and target similar consumer segments. This strategic approach maintains brand coherence while enabling growth opportunities in adjacent categories.

Packaging That Performs in the Cannabis Topicals Category

Primary Packaging Types & Specifications

Jars: Glass, PET, and PP Options

Glass jars represent the premium standard for cannabis topicals, offering superior chemical compatibility, UV protection capabilities, and consumer perception benefits. Common volume ranges include 15ml, 30ml, and 60ml, with straight-sided configurations preferred for label application and manufacturing efficiency. Closure options span twist-off caps, child-resistant mechanisms, and specialty systems incorporating tamper-evidence features.

Liner selection critically impacts product integrity and shelf life. Pulp/vinyl liners provide basic moisture protection, while foam liners with specialized coatings offer enhanced barrier properties for volatile formulations. Induction heat sealing enables tamper-evidence while maintaining hermetic seals that preserve product potency and prevent contamination.

PET containers offer weight reduction and breakage resistance compared to glass while maintaining reasonable barrier properties for most topical formulations. However, PET compatibility with high-terpene formulations requires careful evaluation, as certain terpene compounds can cause stress cracking or permeation over extended storage periods.

Airless Systems: Technology and Positioning

Airless dispensing systems prevent oxidation and contamination while enabling precise dosing control for premium formulations. These systems require careful fill volume calculations to accommodate expansion chambers and pump priming requirements. Compatibility testing becomes critical with viscous formulations and particle-containing products that could interfere with pump mechanisms.

Premium positioning justifies the 3-5x cost premium airless systems command over conventional dispensing options. These systems particularly benefit anti-aging and therapeutic formulations where oxidation prevention directly impacts product efficacy and consumer satisfaction.

Tubes: Diameter and Length Specifications

Tube packaging offers cost-effective dispensing for cream and gel formulations while providing portion control and contamination prevention. Standard diameter options range from 13mm to 35mm, with length varying based on fill volume requirements. Laminate constructions provide enhanced barrier properties compared to mono-material alternatives, though recycling considerations increasingly favor single-material designs.

Shoulder and cap design impact dispensing characteristics and user experience. Flip-top closures enable single-handed operation while maintaining product hygiene, while screw caps offer superior seal integrity for high-value formulations.

Roll-On Assemblies: Materials and Sealing

Rollerball materials significantly impact product compatibility and user experience. Glass rollerballs offer superior chemical resistance and smooth application but increase breakage risks during shipping and use. Plastic alternatives provide durability advantages while requiring careful compatibility evaluation with terpene-rich formulations.

Sealing mechanism design prevents leakage while ensuring reliable product dispensing throughout the container’s lifecycle. Ball retention systems must balance secure assembly with smooth rolling action that doesn’t impede product flow or create user frustration.

Compliance-Driven Design Requirements

Every cannabis topical format requires certified child-resistant (CR) features that meet ASTM D3475 and CFR Title 16 standards. Push-and-turn caps represent the most common CR mechanism for jars, while squeeze-and-turn systems accommodate tubes and bottles. Senior-friendly designs balance child resistance with accessibility for consumers with dexterity limitations.

Tamper-evident features range from shrink bands and induction seals to breakaway tabs and locking mechanisms. Integration with CR systems requires careful engineering to ensure both functions operate reliably throughout the product’s lifecycle without compromising user experience.

THC symbol requirements vary significantly by state, with some jurisdictions mandating specific symbol designs, sizes, and placement specifications. California requires universal cannabis symbols measuring at least ½ inch by ½ inch, while other states permit alternative warning approaches. Label real estate planning must accommodate these requirements while preserving branding opportunities and product differentiation.

Potency display standards dictate how cannabinoid content information must be presented, including serving size calculations, total package potency, and measurement units. Some states require both percentage and milligram specifications, necessitating careful label layout planning to accommodate multiple data presentation requirements.

Material Compatibility with Active Ingredients

High-concentration terpene formulations can cause environmental stress cracking in certain plastic materials, particularly polycarbonate and some acrylic polymers. Material selection requires compatibility testing under accelerated aging conditions that simulate extended storage and temperature cycling scenarios.

Glass coating options including UV-resistant treatments and barrier coatings provide enhanced product protection while maintaining material compatibility advantages. However, these specialized treatments increase costs and may require minimum order quantities that impact inventory management strategies.

Gasket materials must resist degradation from cannabinoid and terpene exposure while maintaining effective sealing properties throughout the product’s shelf life. Silicone gaskets offer superior chemical resistance compared to rubber alternatives, though costs increase proportionally. Liner attack resistance testing validates material selection under worst-case exposure scenarios.

Sustainability Implementation Strategies

PCR plastic incorporation addresses environmental concerns while meeting regulatory requirements in states like New York, which mandates 25% minimum PCR content. However, PCR materials may exhibit color variations and processing challenges that require careful supplier management and quality control protocols.

Recycling symbol placement and consumer education become critical for sustainable packaging programs’ success. Clear recycling instructions and material identification enable proper post-consumer disposal while supporting circular economy objectives.

Child-resistant mechanisms and multi-material constructions complicate recycling processes while meeting mandatory safety requirements. Design approaches that minimize material mixing and enable easy disassembly support sustainability objectives without compromising regulatory compliance.

Refillable packaging systems represent innovative approaches to waste reduction, though implementation requires careful consideration of contamination prevention, product stability, and regulatory acceptance in controlled substances markets.

Operational Excellence Considerations

Stock vs. Custom Lead Times

Standard packaging options offer 2-4 week lead times and lower minimum order quantities compared to custom solutions requiring 8-16 weeks for tooling and production. Custom packaging justifies longer development cycles for established brands with predictable volume requirements and differentiation needs.

Decoration options including silk screening, hot stamping, and digital printing provide branding opportunities while accommodating compliance labeling requirements. MOQ considerations often favor stock packaging for new product launches and custom solutions for established SKUs with proven demand patterns.

Logistics and Distribution Optimization

Freight protection strategies become critical for glass packaging, requiring appropriate cushioning materials and shipping container design to prevent breakage during distribution. ISTA testing protocols validate packaging performance under transportation stress scenarios, preventing costly product losses and customer satisfaction issues.

Shelf-life simulation testing validates packaging performance under various storage conditions, ensuring product stability throughout distribution cycles and retail shelf life. Accelerated aging studies enable expiration date establishment while identifying potential packaging-product interaction issues before market introduction.

Claims, Testing & Quality Assurance

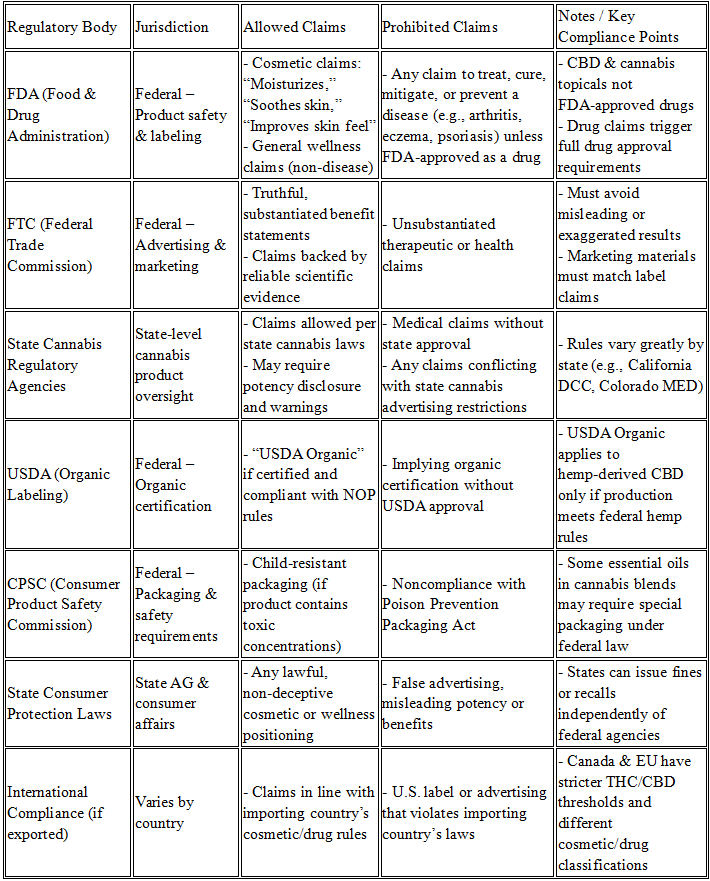

Regulatory Boundaries for Product Claims

Cannabis topicals operate within complex regulatory frameworks that restrict therapeutic claims while permitting general wellness messaging. FDA guidelines prohibit disease claims for non-prescription cannabis products, requiring brands to focus on sensory and experiential descriptors rather than specific medical benefits. Acceptable claim categories include “soothing,” “moisturizing,” and “cooling” effects that describe immediate sensory experiences rather than therapeutic outcomes.

Certificate of Analysis Integration

COA transparency has become a market differentiator, with leading brands providing QR code access to batch-specific testing results. These documents typically include cannabinoid potency verification, pesticide screening, heavy metal analysis, and microbial contamination testing. Third-party laboratory testing provides credibility, though inconsistent testing standards across states create challenges for multi-market brands.

Modern consumers increasingly expect COA access as a baseline quality indicator, with 67% of CBD users reporting they review testing data before purchase decisions. Brands that provide comprehensive, easily accessible testing information build consumer trust while demonstrating commitment to product quality and safety.

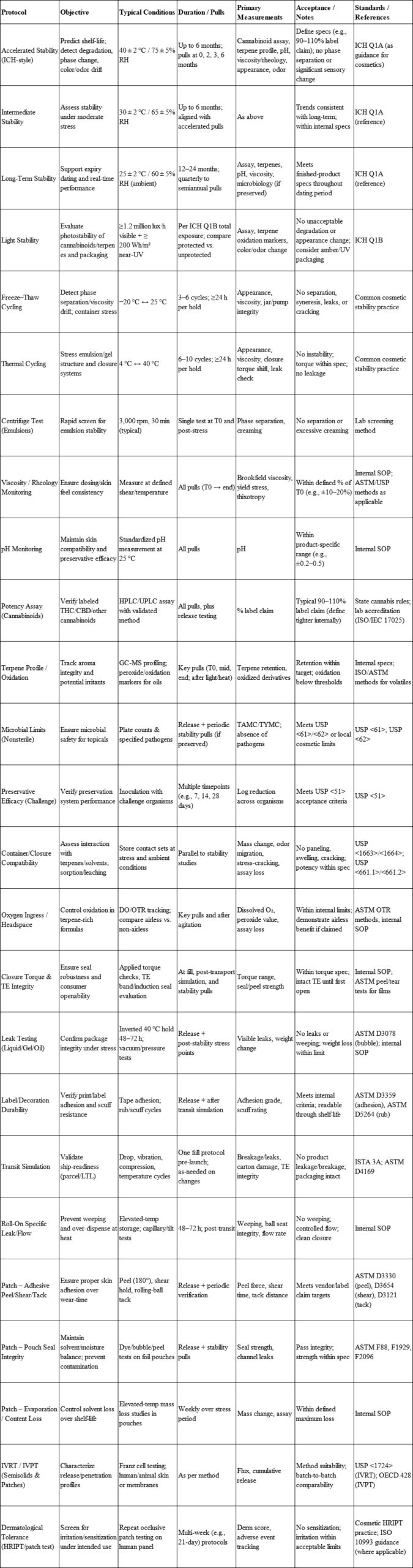

Stability and Compatibility Testing Protocols

Accelerated aging studies evaluate product stability under elevated temperature and humidity conditions, enabling shelf-life determination and expiration dating. Terpene retention testing becomes particularly critical for products marketed based on specific aromatic profiles or therapeutic terpene content. Container interaction studies validate packaging material compatibility over extended storage periods.

Microbiological stability testing ensures product safety throughout the intended shelf life, particularly for products containing botanical extracts or water-phase ingredients that could support microbial growth. Temperature cycling studies simulate distribution and storage conditions to identify potential stability issues before market introduction.

Future Directions in Cannabis Topicals & Packaging Innovation

Advanced Ingredient Innovation

Rare cannabinoids including CBDV, THCV, and CBC create differentiation opportunities as extraction and purification technologies improve cost-effectiveness. These compounds offer distinct therapeutic profiles that enable highly targeted product positioning for specific consumer needs. Adaptogen integration represents another innovation frontier, with compounds like ashwagandha and rhodiola providing complementary stress-reduction benefits that align with cannabis wellness positioning.

Advanced penetration enhancer development focuses on increasing cannabinoid bioavailability through improved delivery mechanisms. Nanotechnology applications enable enhanced absorption while reducing required cannabinoid concentrations, potentially improving cost-effectiveness and therapeutic outcomes.

Smart Packaging Technology Integration

Freshness indicators provide visual confirmation of product quality, addressing consumer concerns about degradation and potency loss over time. These systems typically utilize oxygen-sensitive dyes that change color when product exposure exceeds safe limits, providing immediate quality feedback.

NFC-enabled authentication systems combat counterfeiting while providing interactive consumer experiences through tap-enabled content access. Blockchain integration enables complete supply chain traceability, addressing regulatory requirements while building consumer trust through transparency. Interactive QR codes can provide dynamic content including usage instructions, educational materials, and promotional offers that enhance customer engagement.

Regulatory Harmonization Opportunities

Federal rescheduling discussions could significantly impact state-level regulatory requirements, potentially enabling standardized packaging and labeling requirements across jurisdictions. However, implementation timelines remain uncertain, requiring brands to maintain flexibility in packaging and compliance strategies.

Cross-market scaling opportunities will likely favor brands that develop modular packaging systems capable of accommodating varying regulatory requirements without complete redesign. Investment in flexible manufacturing and compliance systems positions companies for rapid expansion as regulatory harmonization progresses.

Conclusion

Cannabis topicals represent a sophisticated convergence of wellness innovation, beauty science, and compliance-driven CPG manufacturing. This category’s success stems from its ability to deliver immediate, localized therapeutic benefits while avoiding the regulatory complexity and consumer apprehension associated with psychoactive cannabis products. The projected market growth to $1.3-4.5 billion by 2025 reflects not just expanding consumer acceptance, but the category’s fundamental strength as a bridge between traditional wellness products and cannabis therapeutics.

Success in cannabis topicals requires mastery of multiple complex disciplines: formulation science that optimizes cannabinoid and terpene synergies, packaging engineering that balances compliance requirements with user experience, and brand positioning that builds consumer trust while navigating regulatory constraints. Leading brands distinguish themselves through scientific rigor in product development, transparency in quality assurance, and innovation in sustainable packaging solutions that align with evolving consumer values.

The future of cannabis topicals will be defined by brands that excel at the intersection of three critical competencies: advanced formulation science that maximizes therapeutic efficacy, intelligent packaging systems that enhance both compliance and consumer experience, and transparent quality programs that build lasting consumer trust. As regulatory frameworks evolve and consumer sophistication increases, the topicals category is positioned to lead cannabis industry innovation while establishing new standards for wellness product development and marketing excellence.