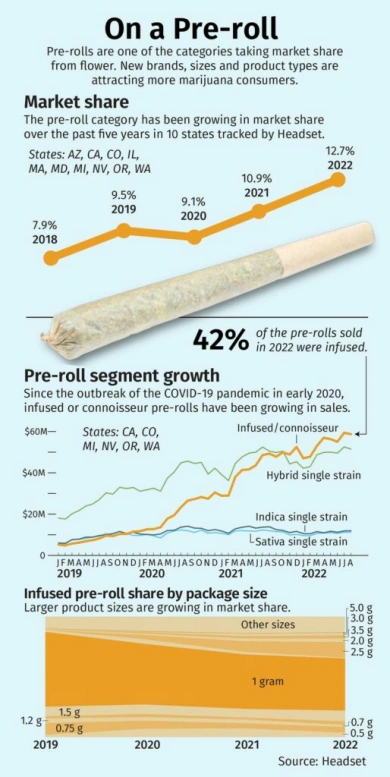

The cannabis pre-roll market has undergone a remarkable transformation, evolving from a perceived “budget option” to the fastest-growing category in the legal cannabis industry. What was once considered a convenient afterthought has become a sophisticated product segment driving significant innovation and investment across North America.

The numbers tell a compelling story of growth and consumer adoption. The pre-roll market generated $4.1 billion in sales with an impressive 11.9% year-over-year growth rate, demonstrating sustained momentum even as the broader cannabis market faces headwinds. In 2024-2025, consumers purchased approximately 394 million pre-roll units, representing a massive shift in consumption patterns and preferences.

This growth trajectory reflects fundamental changes in how consumers approach cannabis consumption. Modern pre-rolls offer unprecedented convenience for busy professionals, casual consumers, and medical patients who value ready-to-use products without the complexity of grinding, rolling, or dosing. The category has attracted significant investment, leading to innovations in product formulation, packaging technology, and manufacturing processes that rival traditional consumer goods industries.

The pre-roll revolution extends beyond simple convenience. Today’s market features sophisticated product categories including infused pre-rolls with concentrates, CBD-dominant options for wellness-focused consumers, and artisanal products crafted with premium flower. Multi-pack offerings now represent nearly 50% of all sales, indicating consumer appetite for variety and value.

This comprehensive guide examines the pre-roll industry from multiple perspectives: market dynamics and growth trends, product innovation and categories, packaging breakthroughs, consumer behavior patterns, regulatory compliance challenges, and future opportunities. Whether you’re an industry professional, investor, or curious consumer, understanding the pre-roll market provides crucial insights into the broader cannabis industry’s evolution and its trajectory toward mainstream acceptance.

Market Analysis and Growth Trends

Current Market Performance

The cannabis pre-roll market has achieved remarkable scale and continues expanding at rates that outpace many traditional consumer product categories. Current market data reveals $3.1 billion in U.S. sales alone, with consumers purchasing approximately 316 million pre-rolled joints in 2024. This represents roughly 15% of the total legal cannabis market, a significant increase from historical single-digit market share percentages.

Market projections indicate continued robust growth, with industry analysts forecasting the pre-roll segment will exceed $4 billion by 2025. This growth rate consistently outperforms other cannabis categories, including flower, edibles, and concentrates, making pre-rolls the industry’s most dynamic product segment.

The market’s expansion reflects broader trends toward convenience and accessibility in consumer goods. Pre-rolls eliminate traditional barriers to cannabis consumption, including the need for specialized knowledge about grinding techniques, rolling papers, or dosing calculations. This accessibility has opened cannabis consumption to demographic segments previously hesitant to engage with the plant.

Regional Market Insights

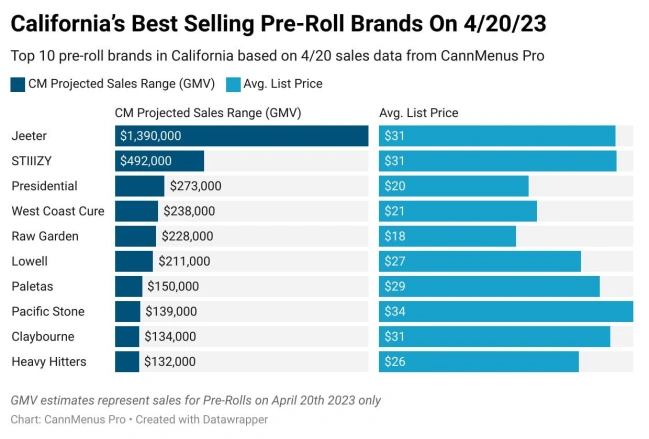

California dominates the U.S. pre-roll market, generating $178.1 million in quarterly sales and representing 16.1% of the state’s total cannabis market. This outsized influence reflects California’s mature regulatory framework, sophisticated consumer base, and concentration of innovative cannabis brands driving product development.

The California market demonstrates several trends likely to influence other regions. Infused pre-rolls command premium pricing and represent the fastest-growing subcategory. Multi-pack offerings appeal to variety-seeking consumers, while sustainability-focused packaging resonates with environmentally conscious Californians.

Canada presents an interesting contrast to U.S. market dynamics. Canadian consumers show stronger preferences for standardized products and government-regulated quality controls, while U.S. consumers gravitate toward artisanal and craft-focused offerings. These differences reflect varying regulatory approaches and cultural attitudes toward cannabis consumption.

Emerging markets in newly legalized states present significant expansion opportunities. States like New York, Connecticut, and Rhode Island are implementing recreational cannabis programs, creating demand for established pre-roll brands to enter new territories. However, varying state regulations require adaptable business models and packaging compliance strategies.

Key Growth Drivers

Consumer accessibility remains the primary factor driving pre-roll market expansion. Research indicates that 73% of pre-roll consumers cite convenience as their primary purchase motivation, while 68% appreciate the consistent dosing and 61% value the elimination of preparation time.

Investment levels significantly impact market growth and product innovation. Well-funded companies can invest in automated manufacturing equipment, sophisticated packaging solutions, and comprehensive marketing campaigns that drive consumer awareness. This investment advantage creates competitive moats for established players while raising barriers for new market entrants.

The convenience factor extends beyond simple preparation time savings. Pre-rolls appeal to social consumption scenarios, travel situations, and medical patients with limited dexterity. This broad appeal across consumer segments creates multiple revenue streams and market expansion opportunities that traditional flower products cannot match.

Product Categories and Types

Traditional Pre-Rolls

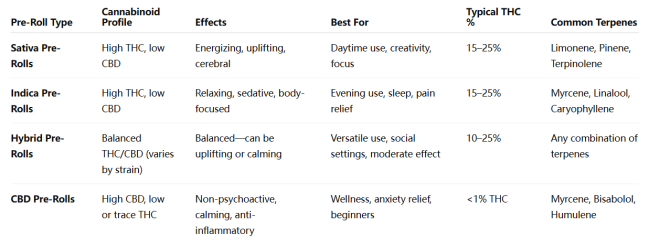

The foundation of the pre-roll market rests on traditional flower-based products categorized by their cannabis strain genetics and expected effects. Sativa pre-rolls dominate daytime consumption patterns, offering energizing effects that appeal to consumers seeking creativity enhancement and focus. Popular sativa strains include Sour Diesel, Jack Herer, and Green Crack, which typically contain higher concentrations of limonene and pinene terpenes associated with alertness and mental clarity.

Indica pre-rolls serve the evening and nighttime consumption market, providing relaxing effects that help with stress relief and sleep preparation. Strains like Granddaddy Purple, Northern Lights, and Bubba Kush contain higher concentrations of myrcene and linalool terpenes, which research suggests contribute to sedating effects. Medical patients frequently choose indica pre-rolls for pain management and anxiety reduction.

Hybrid pre-rolls represent the largest traditional category, offering balanced effects suitable for any time consumption. These products blend sativa and indica genetics to provide customized effects profiles. Popular hybrids include Blue Dream, Girl Scout Cookies, and OG Kush, which offer moderate psychoactive effects without extreme sedation or stimulation.

CBD pre-rolls have emerged as a significant category serving wellness-focused consumers seeking therapeutic benefits without intoxication. These products typically contain less than 0.3% THC while featuring 15-25% CBD concentrations. Hemp-derived CBD pre-rolls operate in a different regulatory framework and appeal to consumers in non-recreational states.

Infused Pre-Rolls: The Game Changer

Infused pre-rolls represent the most dynamic and fastest-growing segment of the pre-roll market, commanding 44.4% of overall market share and reaching 66.3% of California’s pre-roll sales. These premium products incorporate various cannabis concentrates to enhance potency, flavor, and effects duration.

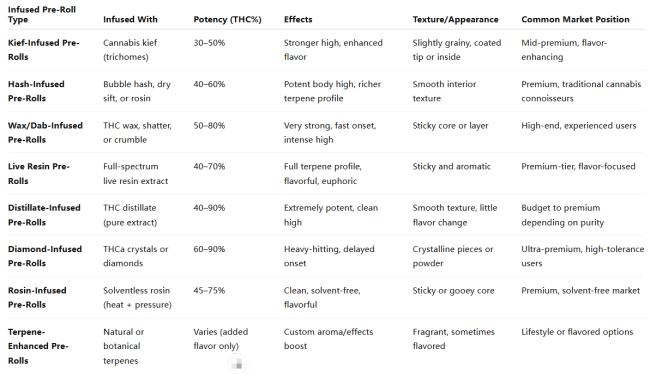

Kief-infused pre-rolls represent the most accessible infusion method, incorporating the trichome-rich powder collected during flower processing. Kief adds 5-15% additional THC content while maintaining the original strain’s terpene profile. Manufacturing costs remain relatively low, making kief-infused pre-rolls an entry point for premium positioning.

Live resin infusions command higher price points due to their superior terpene preservation and enhanced flavor profiles. Live resin extraction processes freeze fresh cannabis immediately after harvest, preserving volatile compounds that traditional curing methods eliminate. These pre-rolls typically cost 30-50% more than standard options but appeal to connoisseur consumers seeking premium experiences.

Oil and distillate infusions offer precise potency control and consistent effects. Manufacturers can incorporate specific cannabinoid ratios and custom terpene blends to create targeted effects profiles. These products appeal to medical patients requiring consistent dosing and recreational consumers seeking predictable experiences.

Hash-infused pre-rolls represent the luxury tier of infused products, incorporating traditional hash-making techniques with modern pre-roll manufacturing. These products often feature multiple infusion layers, including flower, hash, and oil combinations that create complex effects profiles and premium pricing opportunities.

Specialty and Emerging Products

Multi-pack offerings have revolutionized pre-roll purchasing patterns, representing nearly 50% of all sales volume. These packages typically contain 3-5 pre-rolls featuring different strains or effects profiles, allowing consumers to experience variety without purchasing multiple individual products. Multi-packs also offer better value propositions, with per-unit costs typically 15-25% lower than individual purchases.

Hemp pre-rolls serve consumers in non-recreational states and those seeking CBD benefits without THC intoxication. These products must contain less than 0.3% THC by federal law but can feature high CBD concentrations and diverse terpene profiles. Popular hemp strains include Cherry Wine, Lifter, and Suver Haze, which offer distinct flavors and effects without psychoactive properties.

Flavored pre-rolls incorporate natural and artificial terpenes to enhance taste profiles beyond traditional cannabis flavors. Popular options include citrus, berry, mint, and tropical fruit flavors that appeal to consumers transitioning from traditional tobacco products. However, regulatory restrictions in some states limit flavoring options, particularly those appealing to minors.

Organic pre-rolls address growing consumer demand for pesticide-free and environmentally sustainable cannabis products. These products command premium pricing but appeal to health-conscious consumers willing to pay more for clean cultivation practices. Organic certification requires compliance with strict agricultural standards and regular third-party testing.

Mini pre-rolls serve microdosing consumers and those seeking portion control. These products typically contain 0.25-0.5 grams compared to standard 1-gram pre-rolls, allowing consumers to manage their intake more precisely. Mini pre-rolls also enable sampling of multiple strains without excessive consumption or waste.

Packaging Innovation and Trends

Types of Pre-Roll Packaging Containers

The pre-roll packaging landscape has evolved dramatically, moving beyond basic plastic tubes to sophisticated container systems that protect product integrity while enhancing brand differentiation. Traditional plastic pop-top tubes remain the most widely adopted solution due to their affordability and child-resistant compliance. These polypropylene containers feature moisture barrier properties essential for maintaining pre-roll freshness during extended shelf life periods. Available in numerous colors for brand differentiation, these containers meet ASTM D-3475 safety compliance standards for child resistance while providing cost-effective protection for mass-market products.

Glass tubes with cork or screw cap closures represent premium positioning strategies for luxury cannabis brands. These containers offer superior freshness protection through enhanced airtight sealing capabilities and provide elegant aesthetics that justify premium pricing. While glass options carry higher costs and increased breakage risks during transportation, their reusability appeals to environmentally conscious consumers and reinforces brand quality perceptions.

Metal and tin containers provide exceptional durability and crush resistance, making them ideal for premium product lines and limited edition collections. These containers excel at maintaining product integrity during transport and handling, while their substantial feel communicates quality and value to consumers. Pre-roll tin packaging has gained popularity among craft cannabis brands seeking to differentiate their products through distinctive packaging experiences.

Multi-pack solutions have revolutionized pre-roll packaging with custom variety pack containers designed for consumer convenience. Standard configurations include 3-5 pre-roll packages in classic sizes (24mm, 28mm, and 38mm diameters) with specialized king-size containers accommodating larger 110mm pre-rolls. These containers utilize both PET plastic and glass construction while maintaining child-resistant features required by regulations.

Flexible packaging options provide space-efficient alternatives with excellent preservation characteristics. Mylar bags and specialized barrier bags offer superior protection from moisture and light exposure while reducing packaging costs and storage requirements. Available in multiple colors including black, gold, and kraft finishes, these options enable cost-effective bulk packaging and transportation. Paper tubes and boxes serve as sustainable packaging alternatives, utilizing recyclable materials that appeal to eco-conscious consumers while providing customizable printing and branding opportunities.

Sustainability and Eco-Friendly Innovations

Environmental considerations increasingly drive packaging innovation as consumers demand sustainable alternatives to traditional plastic containers. Hemp-based packaging materials represent the cutting edge of biodegradable alternatives, utilizing cannabis industry byproducts to create fully compostable containers. These innovations align with cannabis industry values while reducing environmental impact through circular economy principles.

Recyclable glass and metal options enable reusable container programs that enhance brand loyalty while reducing waste. Premium brands leverage these materials to create collectible packaging that consumers retain and repurpose, extending brand engagement beyond initial purchase. Modified atmosphere packaging (MAP) systems utilize nitrogen-based preservation technology to extend product freshness without chemical preservatives, appealing to health-conscious consumers seeking natural preservation methods.

Smart packaging technology integration includes QR code systems connecting consumers to comprehensive product information, including lab test results, strain details, and consumption recommendations. This digital connectivity enhances consumer education while providing brands with valuable engagement data and opportunities for ongoing customer relationships.

Brand Case Studies and Market Examples

High Season has revolutionized premium convenience with their distinctive metallic blue text on matte black slider boxes featuring integrated match compartments with lighting strips. This innovative design eliminates consumer need for separate lighters while positioning the brand in the luxury market segment through functional convenience. The packaging innovation enhances user experience while creating memorable brand interactions that drive customer loyalty and word-of-mouth marketing.

Emjayze Hemp Goods demonstrates sustainable branding leadership through cigarette-style packaging constructed entirely from hemp materials. Their organic approach extends throughout their product line, appealing to environmentally conscious consumers in markets like Texas where hemp products provide legal cannabis alternatives. The clean, minimalist aesthetic supports their natural brand values while communicating quality and environmental responsibility.

Canndescent’s consumer education focus utilizes mood-based variety packs with sophisticated color-coded systems that simplify strain selection for consumers overwhelmed by traditional cannabis terminology. Their comprehensive strain guides and effect descriptions reduce consumer confusion while building brand trust through educational packaging approaches. This strategy has driven significant market share gains in California’s competitive market.

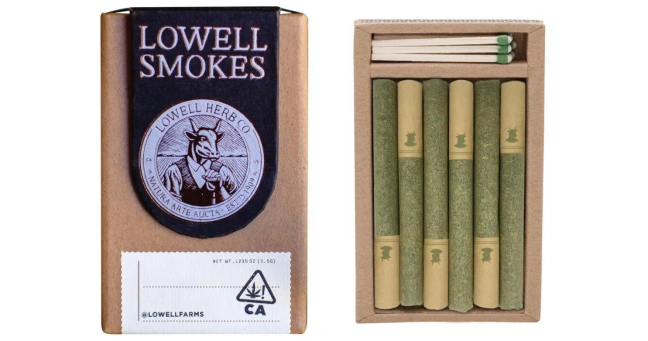

Lowell’s Pre-Rolls maintains market leadership as California’s number one selling pre-roll brand through their commitment to 100% recyclable materials and custom logo stamping on kraft paper construction. Their sustainability focus aligns with California’s environmental values while their pioneering eighth and quarter pack formats established industry standards for multi-pack offerings.

Shadowbox Farms leverages Pacific Northwest heritage through wooden box packaging that showcases regional identity and artisanal quality. Their branded variety packs and 3-packs for Oregon’s market include strain name cards and detailed descriptions that enhance consumer education and product value perception. This regional branding approach creates emotional connections that transcend traditional product attributes.

Bloom Farms pioneered industry legitimacy through classic foil packaging with debossed typography that moved away from traditional cannabis stereotypes. Their subtle elegance attracted mainstream and casual consumers while setting precedents for sophisticated cannabis packaging standards that influenced industry-wide aesthetic evolution.

Consumer Behavior and Preferences

Usage Patterns and Demographics

Contemporary pre-roll consumption patterns reveal sophisticated consumer behavior that challenges traditional cannabis market assumptions. Research indicates that 80% of regular pre-roll consumers use cannabis multiple times daily, suggesting these products serve routine consumption needs rather than occasional recreational use. This frequency pattern indicates pre-rolls have achieved integration into daily wellness and lifestyle routines similar to other consumer packaged goods.

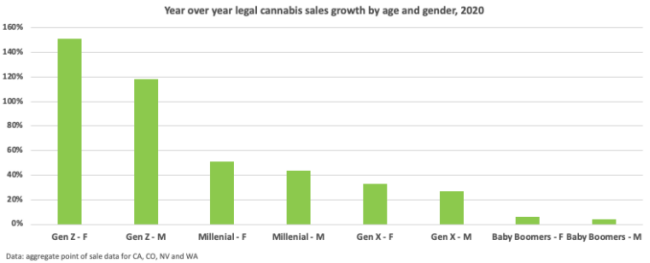

Demographic analysis reveals pre-roll consumers span diverse age groups, income levels, and consumption experience levels. Millennials and Generation X consumers represent the largest market segments, with 34% and 28% market share respectively. However, Baby Boomer adoption has accelerated significantly, growing 23% year-over-year as medical cannabis acceptance increases among older demographics.

Gender distribution shows near-equal consumption rates, with women representing 48% of pre-roll consumers compared to 52% men. This balance contrasts with other cannabis categories that skew heavily male, suggesting pre-rolls appeal broadly across gender lines. Women consumers particularly value consistent dosing and convenient consumption methods that fit busy lifestyles.

Income analysis reveals pre-roll consumers across economic segments, though higher-income consumers gravitate toward premium and infused products while price-sensitive consumers focus on value-oriented traditional options. Households earning $75,000+ annually represent 41% of premium pre-roll sales, while those earning under $50,000 comprise 38% of traditional pre-roll purchases.

Purchase Motivation and Decision Factors

Potency considerations drive 67% of consumer purchase decisions, with THC content serving as the primary quality indicator for recreational users. However, medical consumers increasingly prioritize CBD ratios and specific terpene profiles for targeted therapeutic effects. This sophistication in consumer knowledge has pushed brands toward detailed lab testing disclosure and strain-specific marketing approaches.

Pricing sensitivity varies significantly across consumer segments and purchase contexts. Regular consumers demonstrate higher price tolerance for preferred brands and premium products, while occasional users focus primarily on value propositions. Multi-pack offerings successfully balance these preferences by providing per-unit savings while enabling strain variety exploration.

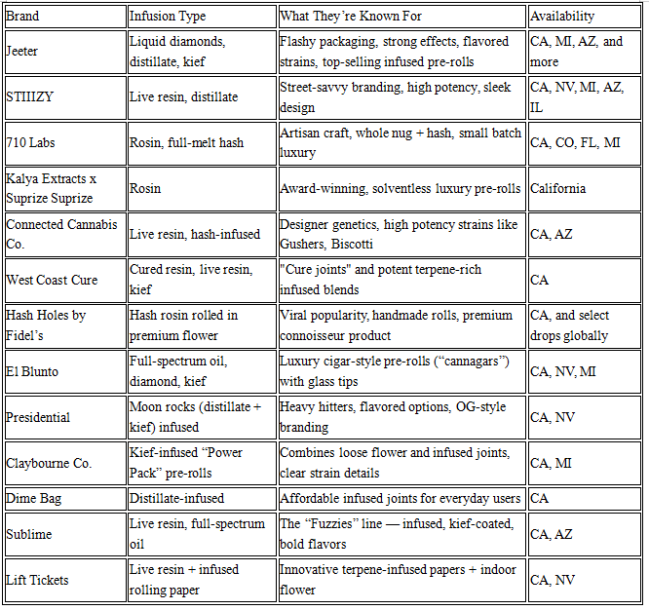

Brand recognition plays an increasingly important role as market maturity increases and product quality standardizes across manufacturers. Established brands like Jeeter, Raw Garden, and Stiiizy command premium pricing through consistent quality and effective marketing, while emerging brands compete primarily on price and product innovation.

Dispensary influence remains significant, with budtender recommendations affecting 43% of purchase decisions. However, this influence decreases among experienced consumers who develop brand preferences and product knowledge through repeated purchases. Online ordering and delivery services reduce budtender interaction while increasing importance of product packaging and brand recognition.

Market Preferences and Consumption Trends

Infused pre-roll demand continues accelerating, with 58% of consumers expressing willingness to pay 25-40% premiums for enhanced potency products. This trend reflects consumer sophistication and willingness to invest in premium experiences rather than simply seeking the lowest prices available.

Multi-pack popularity stems from variety-seeking behavior and value perceptions. Consumers appreciate strain diversity within single purchases, enabling effects customization for different consumption occasions. Three-pack configurations prove most popular for premium products, while five-pack options succeed in value-oriented segments.

Consumption timing patterns show pre-rolls serving both planned and spontaneous consumption occasions. Evening consumption dominates, representing 54% of usage, while afternoon consumption accounts for 28% and morning use comprises 18%. This distribution influences product development, with indica-dominant options outselling sativa varieties in most markets.

Social consumption scenarios drive significant pre-roll sales, with 39% of consumers purchasing pre-rolls specifically for sharing situations. This social aspect differentiates pre-rolls from other cannabis categories and influences packaging design, with brands incorporating sharing-friendly multi-pack configurations and premium presentation options suitable for gifting.

Regulatory Landscape and Compliance

Current Regulatory Framework

The cannabis pre-roll regulatory environment operates through complex state-by-state frameworks that create significant compliance challenges for multi-state operators. Each jurisdiction maintains distinct requirements for packaging, labeling, testing, and marketing that demand sophisticated regulatory compliance programs.

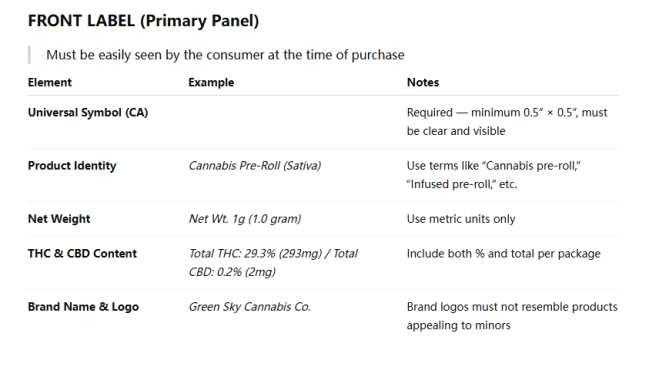

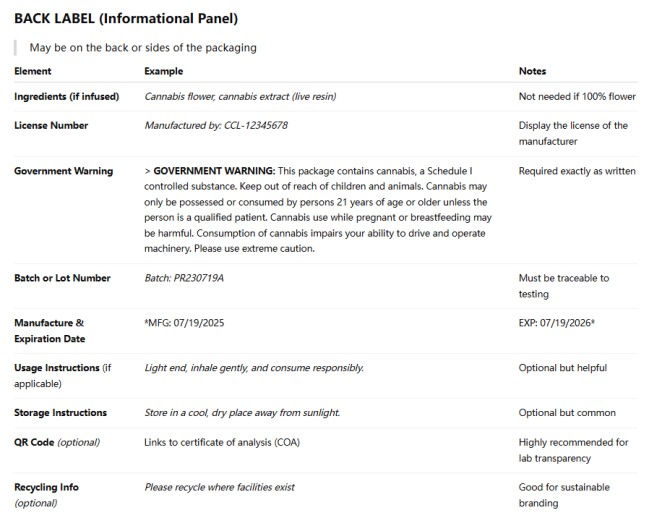

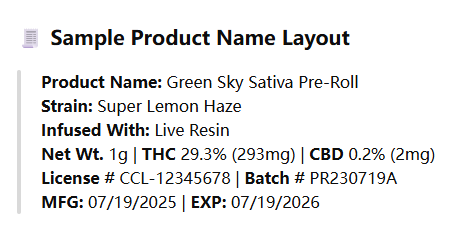

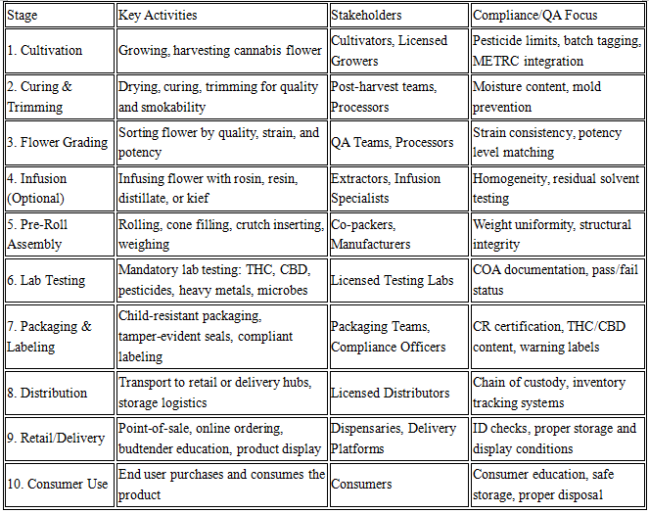

California’s regulations serve as a model for many emerging markets, requiring child-resistant packaging, comprehensive lab testing for potency and contaminants, and detailed labeling including THC/CBD content, harvest dates, and mandatory warning statements. Products must undergo testing for pesticides, heavy metals, microbials, and residual solvents before reaching consumer markets.

Colorado’s established framework emphasizes track-and-trace monitoring from seed to sale, requiring detailed documentation of every pre-roll’s production history. This system enables rapid product recalls when safety issues arise while providing regulatory oversight of industry compliance with state laws.

New York’s recently implemented recreational program includes some of the nation’s strictest packaging requirements, mandating plain white containers with minimal branding elements and extensive warning labels. These regulations reflect concerns about youth access and marketing restrictions that influence packaging innovation possibilities.

Federal regulations remain limited to hemp-derived CBD products containing less than 0.3% THC, which can be sold across state lines without state cannabis program licensing. However, FDA oversight of these products continues evolving, with proposed regulations addressing manufacturing standards and marketing claims.

Packaging and Labeling Compliance

Child-resistant packaging requirements represent universal compliance obligations across all legal cannabis markets. These regulations mandate specialized containers that prevent access by children under five years old while remaining accessible to adults, including those with limited dexterity. Testing protocols require containers to resist opening by 85% of tested children while allowing access by 90% of adults.

Tamper-evident features must demonstrate clear visual indication if products have been accessed after initial packaging. These requirements protect consumer safety while enabling product recalls when contamination or other safety issues arise. Implementation varies across states, with some requiring complete seal destruction while others accept removable but obvious access indicators.

Labeling requirements create significant compliance complexity due to varying state mandates for warning statements, potency disclosure, and product information. Universal requirements include THC and CBD content per unit and per package, batch numbers for traceability, harvest and packaging dates, and laboratory testing facility identification.

Warning statement requirements range from simple intoxication warnings to comprehensive lists addressing pregnancy risks, impaired driving, and interaction with medications. California requires nine distinct warning categories, while Colorado mandates six different statements, creating labeling challenges for brands operating across multiple states.

Testing Standards and Quality Assurance

Comprehensive laboratory testing represents a critical compliance requirement that significantly impacts pre-roll production costs and timelines. Standard testing panels include potency analysis for cannabinoids, terpene profiling, pesticide screening, heavy metals detection, microbial contamination assessment, and residual solvent analysis.

Potency testing must verify THC and CBD content within acceptable variance ranges, typically ±10% of labeled values. This requirement necessitates careful strain selection and consistent manufacturing processes to avoid regulatory violations and product recalls.

Contaminant testing protects consumer safety through detection of potentially harmful substances. Pesticide limits vary across states but generally follow strict maximum residue levels for compounds approved for food production. Heavy metals testing focuses on lead, cadmium, mercury, and arsenic contamination that can occur through contaminated soil or water sources.

Microbial testing screens for dangerous bacteria, yeast, and mold that can cause serious health complications, particularly for immunocompromised medical patients. Testing requirements include total aerobic bacteria, coliforms, E. coli, salmonella, and specific fungal contamination that can proliferate in improperly stored cannabis products.

Mandatory testing creates significant costs, typically adding $200-400 per batch depending on testing scope and laboratory pricing. These expenses particularly burden smaller manufacturers while creating competitive advantages for large-scale operators who can spread testing costs across larger production volumes.

Future Outlook and Opportunities

Market Expansion and Growth Projections

The pre-roll market trajectory indicates sustained growth through 2030, with conservative projections suggesting $6-8 billion in annual sales by decade’s end. This growth will be driven by continued state-level legalization, market maturation in existing jurisdictions, and product innovation that expands consumer appeal beyond traditional cannabis demographics.

Federal legalization possibilities could dramatically accelerate market expansion through interstate commerce, economies of scale, and reduced regulatory compliance costs. Banking access improvements would enable more sophisticated financing for expansion and innovation while reducing operational costs associated with cash-heavy business models.

International market expansion presents significant long-term opportunities as countries including Germany, Mexico, and Australia implement recreational cannabis programs. Canadian companies possess advantages in global expansion due to federal legalization and established international trade relationships, while U.S. companies face restrictions on international operations until federal policy changes.

New state markets continue emerging, with states like Ohio, Minnesota, and Delaware implementing recreational programs that will require pre-roll product offerings. These emerging markets present opportunities for established brands to gain early market share while creating demand for compliant packaging and manufacturing services.

Innovation and Product Development Trends

Advanced infusion technologies will drive premium product development, with manufacturers exploring novel extraction methods and cannabinoid combinations that create unique effects profiles. Live rosin infusions, rare cannabinoid integration (CBG, CBN, Delta-8), and custom terpene blending represent emerging innovation areas with significant market potential.

Precision dosing technology enables micro-dosing pre-rolls with exact cannabinoid content for medical patients requiring consistent therapeutic effects. These products appeal to cannabis-curious consumers seeking predictable, controlled experiences without overwhelming psychoactive effects.

Sustainable packaging innovation will accelerate as environmental concerns influence consumer preferences and regulatory requirements. Biodegradable materials, renewable energy manufacturing, and circular economy principles will become competitive differentiators rather than optional sustainability initiatives.

Smart packaging integration including NFC chips, augmented reality features, and IoT connectivity will enhance consumer engagement while providing brands with valuable usage data. These technologies enable personalized product recommendations, consumption tracking, and loyalty program integration that strengthen customer relationships.

Industry Challenges and Strategic Solutions

Supply chain optimization remains critical as market competition intensifies and profit margins compress. Vertical integration strategies enable greater quality control and cost management, while strategic partnerships can provide access to specialized capabilities without capital investments.

Regulatory compliance complexity requires sophisticated systems and expertise that create barriers for smaller operators while advantaging well-funded companies with compliance infrastructure. Technology solutions including automated compliance monitoring and integrated testing management will become essential competitive tools.

Market saturation in mature jurisdictions demands product differentiation and brand building rather than simple market presence. Premium positioning through quality ingredients, innovative packaging, and targeted marketing will separate successful brands from commodity producers.

Consumer education initiatives will become increasingly important as product complexity increases and new demographics enter cannabis markets. Brands that effectively educate consumers about strain differences, effects profiles, and consumption methods will build stronger customer loyalty and command premium pricing.

Investment and Business Development Opportunities

Consolidation opportunities exist as smaller operators face increasing regulatory and competitive pressures while lacking resources for expansion and innovation. Well-positioned companies can acquire production capacity, brand portfolios, and market share through strategic acquisitions.

Technology investment areas include automated manufacturing equipment, packaging innovations, and consumer engagement platforms that enhance operational efficiency while improving customer experiences. These investments require significant capital but provide sustainable competitive advantages.

Ancillary business opportunities include specialized packaging manufacturers, testing laboratories, and logistics providers serving the growing pre-roll market. These businesses face fewer regulatory restrictions while benefiting from industry growth without direct plant-touching operations.

Partnership opportunities exist between cannabis companies and traditional consumer goods manufacturers seeking cannabis market entry. These relationships can provide capital, expertise, and distribution capabilities that accelerate growth while enabling established companies to enter cannabis markets through experienced partners.

International expansion partnerships will become increasingly valuable as global cannabis legalization progresses and trade barriers diminish. Companies with successful U.S. operations possess valuable expertise for international partners seeking to develop cannabis markets in newly legal jurisdictions.

Conclusion

The cannabis pre-roll market represents one of the most significant success stories in the legal cannabis industry’s brief history. From humble beginnings as a convenience product for budget-conscious consumers, pre-rolls have evolved into a sophisticated category driving innovation across product development, packaging design, and consumer engagement strategies.

Market data clearly demonstrates pre-roll momentum, with $4.1 billion in sales and 11.9% year-over-year growth outpacing most traditional consumer products categories. The 394 million units sold in 2024-2025 represent fundamental shifts in cannabis consumption patterns that extend far beyond simple convenience seeking. Modern consumers view pre-rolls as premium products worthy of investment in quality ingredients, innovative formulations, and sophisticated packaging presentations.

The success factors that have driven pre-roll market growth provide valuable insights for other cannabis categories and consumer goods industries more broadly. Quality consistency, consumer accessibility, packaging innovation, and brand building have proven essential for sustained success in competitive markets. Companies that have embraced these principles while maintaining focus on consumer needs have achieved market leadership and premium pricing power.

Future opportunities in the pre-roll market remain substantial, driven by continued state-level legalization, product innovation, and demographic expansion beyond traditional cannabis consumers. Federal legalization possibilities could dramatically accelerate growth through interstate commerce and reduced regulatory compliance costs, while international expansion presents long-term opportunities for companies with proven success in domestic markets.

The pre-roll revolution demonstrates cannabis industry maturation and mainstream consumer acceptance that seemed impossible just a decade ago. As this dynamic market continues evolving, the companies and products that prioritize consumer experience, quality consistency, and innovative thinking will likely define the industry’s next phase of growth and development.